Buying a home in Australia is a major financial milestone, but the amount you need to earn to afford a property varies significantly depending on the city you’re looking in. Key factors such as median property prices, interest rates, loan-to-value ratios, and additional costs like stamp duty influence the affordability landscape.

Ready to find out how much you can borrow? Start your home loan application today with Broker.com.au.

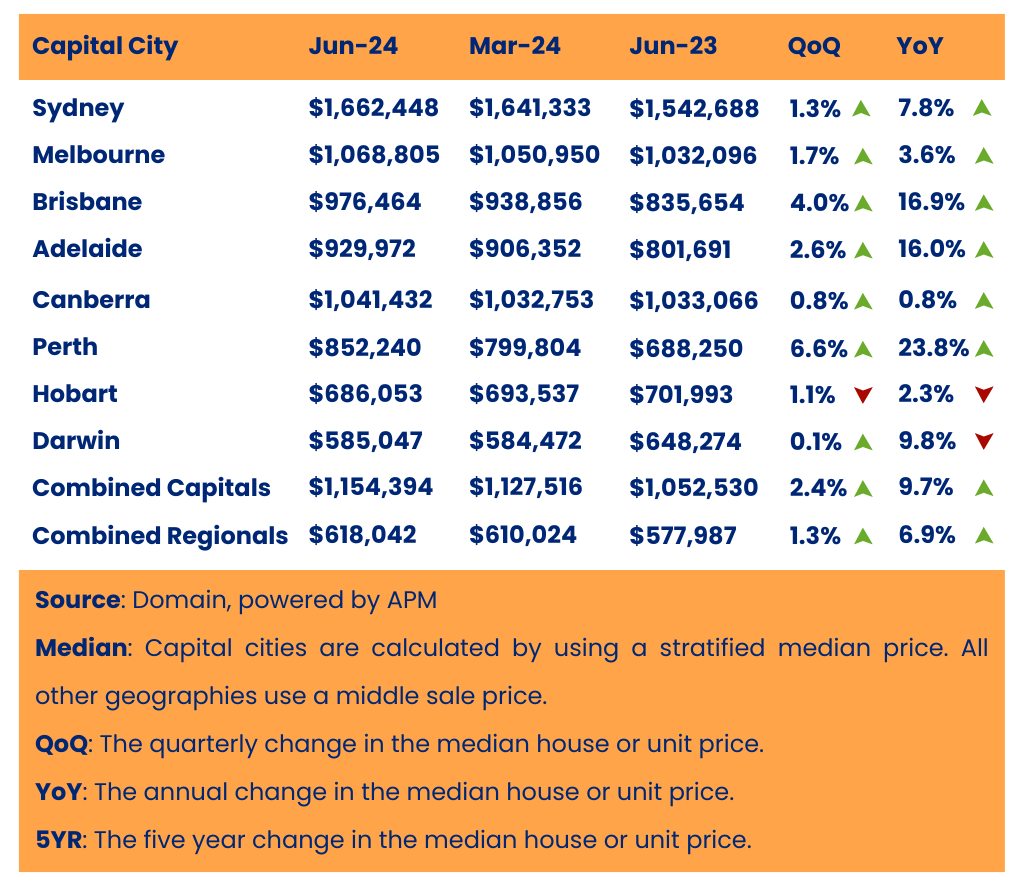

Median House Prices and Required Incomes by City

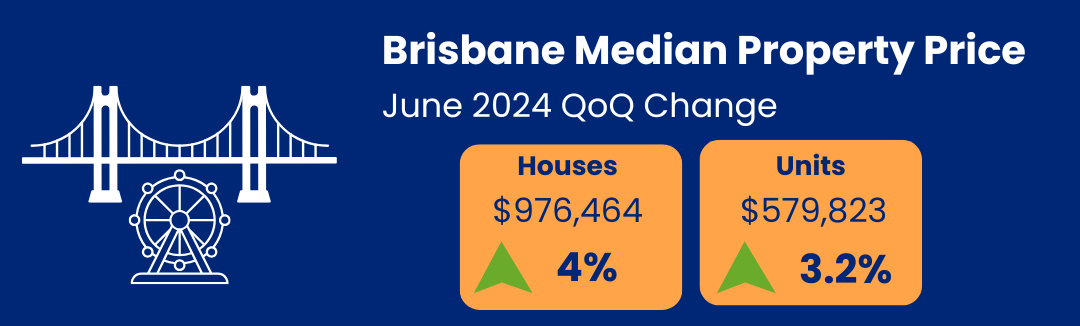

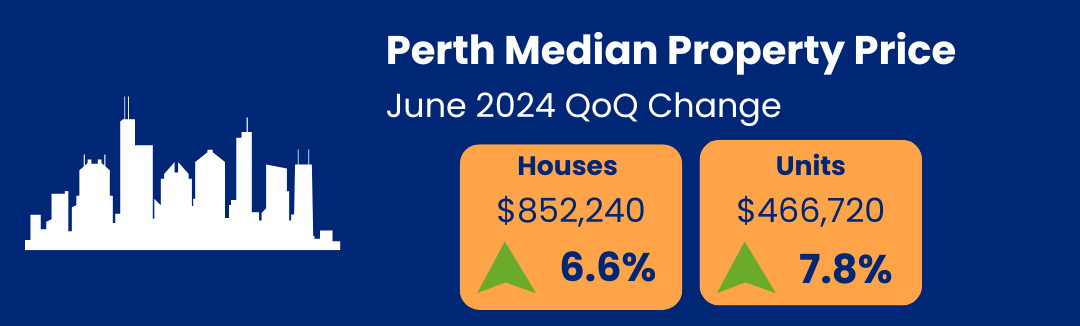

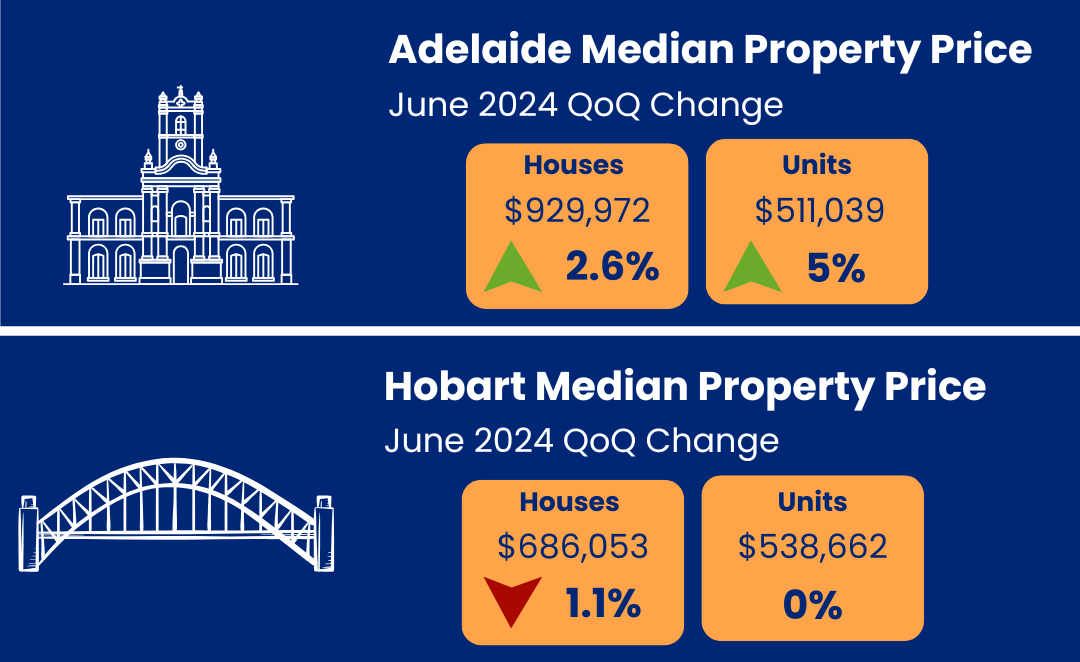

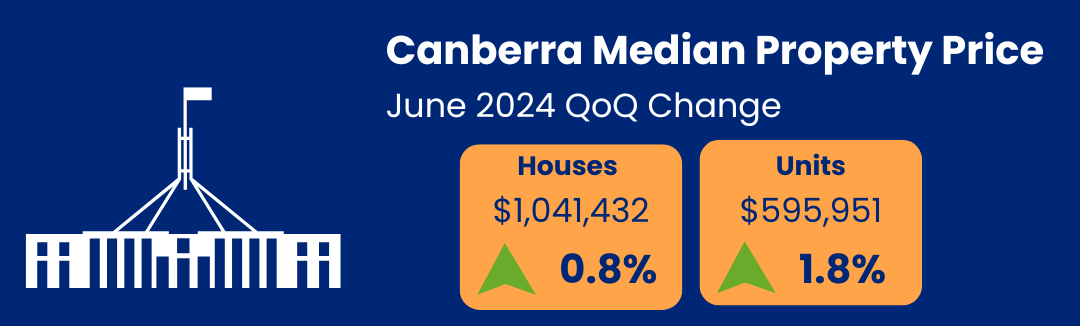

Recent data from sources such as Domain, CoreLogic, and Canstar highlights the stark differences in property markets across Australia’s capitals:

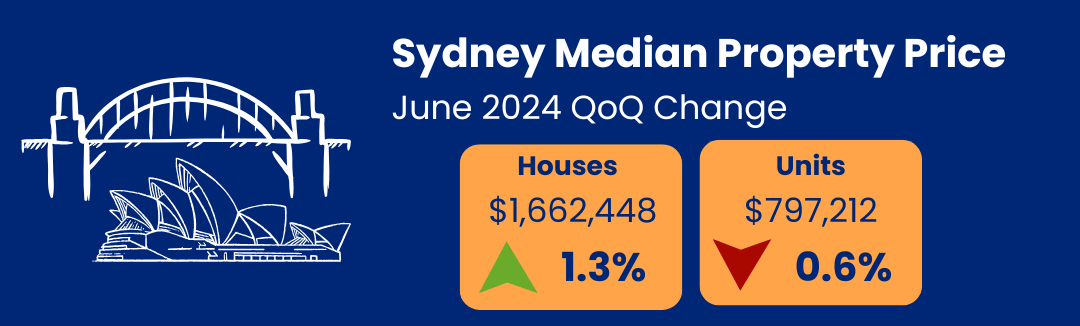

- Sydney: Sydney’s median house price now exceeds $1.5 million, buyers may need an annual household income of over $200,000 to comfortably afford a property, assuming a 20% deposit and a loan with an interest rate around 6%

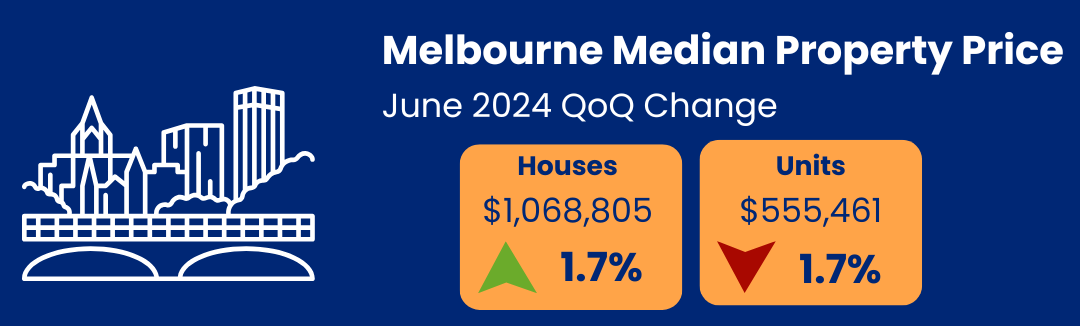

- Melbourne: The median price sits at around $1.07 million. Homebuyers need an annual income of approximately $140,000 to $160,000 to service the mortgage without financial strain

- Brisbane: At a median of $976,000, Brisbane offers relatively affordable options. A household income of around $125,000 to $140,000 is typically required

- Perth: The median house price of approximately $850,000 makes it one of the more affordable capitals, with a required income of about $115,000

- Adelaide and Hobart: These cities have median house prices under $800,000, translating to annual income requirements of $100,000 to $120,000.

- Canberra: With a median of $1.04 million, prospective buyers need an annual income of at least $130,000

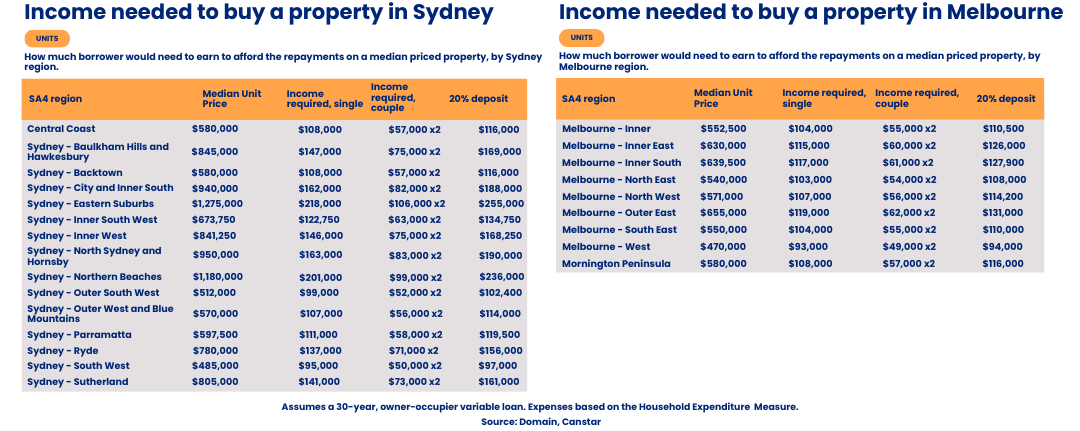

These estimates are influenced by loan repayments not exceeding 30-35% of pre-tax income to ensure affordability. For a comparison of house prices versus units in the country’s two largest cities, the following tables highlight the income required for units in both Sydney and Melbourne:

Explore your borrowing options and compare rates easily — get started with Broker.com.au.

Different Ways Australians Can Purchase Property

Australian homebuyers use various strategies to step into the property market:

- Traditional Mortgages: Most buyers rely on loans from banks or non-bank lenders, contributing a deposit that ranges from 5% to 20%.

- Government Assistance Schemes: Programs like the First Home Guarantee help reduce the deposit requirement to as low as 5%, with the government covering lender’s mortgage insurance costs.

- Co-Ownership Models: Shared equity programs, where buyers co-purchase with a government entity or private partner, are becoming more common.

- Investment Strategies: Some Australians buy smaller investment properties first, leveraging rental income to eventually purchase their dream home.

The Role of Negative Gearing and Tax Breaks

Negative gearing remains a popular investment strategy in Australia. This approach allows investors to deduct the costs of owning a property (e.g., interest on loans, maintenance) against their taxable income if rental income doesn’t cover expenses. While this benefits high-income earners, critics argue it inflates property prices and disadvantages first-time buyers. Other tax breaks include depreciation deductions and capital gains tax concessions for long-term property investments.

Challenges and Opportunities

Rising interest rates, limited housing supply, and high construction costs have tightened affordability in many cities. However, stabilizing interest rates and targeted government policies may provide relief in 2024, as property prices are expected to grow more moderately

For Australians looking to enter the market, understanding city-specific dynamics and exploring government support can be vital in achieving homeownership goals. If you need assistance navigating the complexities of home loans, consider consulting a broker or financial advisor.

Take the first step toward homeownership — apply now through Broker.com.au and see how we can help you get there.

Discover more resources on financial planning and homeownership by visiting our comprehensive Resources & Learning page.