While it might seem complex at first glance, a closer examination can clarify how it works, especially in facilitating transactions between buyers and sellers in international trade.

Streamlining Trade and Mitigating Payment Risks with Letters of Credit

Domestic business transactions are generally straightforward. Sellers assess a buyer’s creditworthiness and, upon approval, issue an invoice for delivered goods. If the buyer defaults, the seller can pursue legal action to recover the owed amount.

However, international transactions present greater risks due to geographic distances, varying legal systems, and the high costs of legal proceedings. Sellers face the risk of non-payment (credit risk), while buyers risk prepaying for goods that might not be delivered or could arrive in substandard condition. Letters of credit addresses these concerns by safeguarding both parties in cross-border transactions.

What Is Letters of Credit?

Letters of credit (LC) is a widely used trade finance tool that guarantees payment for goods and services, provided the terms of the agreement are met. Governed by the International Chamber of Commerce’s Uniform Customs & Practice for Documentary Credits, letters of credit are globally recognized and ensure reliability in trade. They involve a neutral intermediary—typically a bank—that issues the LC and assures payment for goods received.

How a Letter of Credit Works

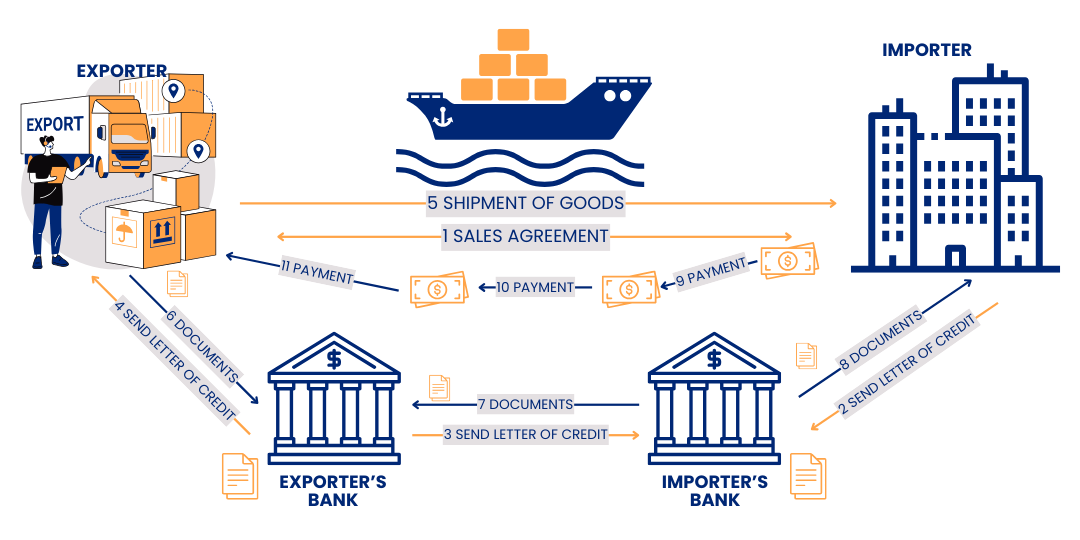

The process for utilizing a letter of credit typically involves the following steps:

- The buyer arranges for a letter of credit to be issued by their bank in favor of the seller.

- The issuing bank sends the LC to a correspondent bank, which forwards it to the seller.

- The seller ships the goods and provides relevant documents to a freight forwarder.

- The freight forwarder dispatches the goods, and the documents are sent to the correspondent bank.

- The correspondent bank verifies the documents and requests payment from the issuing bank on behalf of the seller.

- Payment is debited from the buyer’s account by the issuing bank.

- The issuing bank releases the documents to the buyer, enabling them to claim the goods and clear customs.

Types of Letters of Credit

Various types of letters of credit cater to specific trading scenarios:

- Commercial Letter of Credit: Used in international trade, this LC releases funds only after agreed conditions are fulfilled.

- Standby Letter of Credit (SLOC): Acts as a safety net, becoming payable only if agreed terms are not met, providing compensation in case of non-compliance.

- Confirmed Letter of Credit: A second bank guarantees payment, offering additional assurance to the seller if the buyer’s bank is less trusted.

- Revolving Letter of Credit: Suitable for ongoing transactions, this LC remains valid for multiple payments until it expires, typically within a year.

- Domestic Letter of Credit: Similar to a commercial LC but used for transactions within a single country, with funds released once specific conditions are met.

Benefits and Drawbacks of Letters of Credit

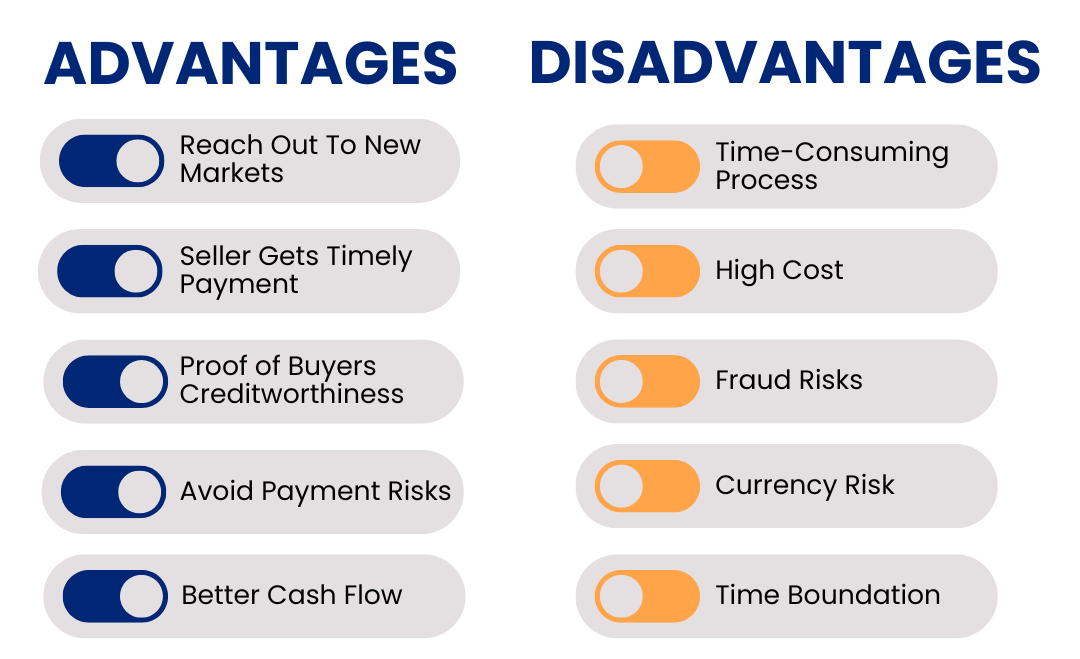

Advantages:

- Minimize disputes in domestic and international trade

- Guarantee payment to sellers

- Offer flexibility with various LC types

- Transfer financial risk to the bank

Disadvantages:

- Incurs additional fees and costs

- Requires meticulous documentation to ensure payment

- Demands collateral from the buyer to secure the LC

Alternative Financing for Importers and Exporters

Wholesale and distribution businesses often face cash flow challenges due to the time gap between purchasing inventory and selling it. Unsecured business loans can bridge this gap by providing working capital.

Online lending platforms, like Broker.com.au, simplify the process by analyzing business financials securely using accounting and banking data. Loan approval is quick, with funds disbursed within 24 hours upon approval. Loan terms range from six months to two years, offering flexibility to address cash flow needs effectively.

Discover how Broker.com.au can help your business overcome financial challenges.

To gain deeper insights into financial tools like letters of credit and other trade finance solutions, explore our Resources & Learning page.