A reverse mortgage is a financial product designed to help older Australians access the equity in their home without selling it. It provides a way for retirees to supplement their income, cover unexpected expenses, or assist family members financially while still living in their home. However, like any loan, it comes with risks and conditions that borrowers must fully understand before proceeding.

In this comprehensive guide, we will cover:

- What a reverse mortgage is and how it works

- The positives and negatives of taking out a reverse mortgage

- Key elements borrowers should consider

- Who to speak with, including mortgage brokers specializing in reverse mortgages

- Why not all mortgage brokers are equipped to handle these loans

- The laws and conditions that must be adhered to

- Examples of how reverse mortgages can be used

What Is a Reverse Mortgage?

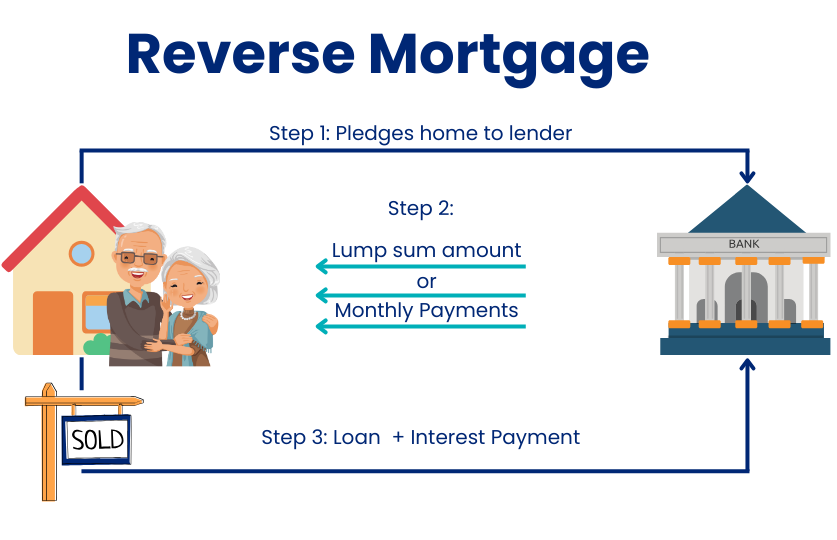

A reverse mortgage is a type of home loan available to Australians aged 60 and older that allows them to borrow money against the value of their home. Unlike a traditional home loan, borrowers do not need to make regular repayments. Instead, the loan (plus interest and fees) is repaid when the home is sold, usually after the borrower moves into aged care or passes away.

How Does It Work?

- The amount you can borrow depends on your age and the value of your property.

- Interest compounds over time, meaning the loan balance grows.

- Borrowers can receive funds as a lump sum, a regular income stream, a line of credit, or a combination of these.

- The lender recovers the loan amount when the property is sold, ensuring that the borrower (or their estate) does not owe more than the home’s sale price (thanks to government protections).

Positives of a Reverse Mortgage

For many retirees, their home is their most valuable asset, but selling isn’t always desirable. A reverse mortgage allows them to stay in their home while using some of its equity.

Unlike traditional loans, borrowers aren’t required to make repayments. The loan is repaid when the house is sold, easing financial pressure in retirement.

Funds can be taken as a lump sum, a regular income, or a line of credit, providing flexibility to suit different financial needs.

Australian laws ensure borrowers (or their estates) can’t owe more than the value of the home, even if the loan balance exceeds the sale price.

Borrowers retain ownership of their home and can live in it for as long as they want.

Common uses include:

- Covering living expenses

- Paying for home renovations or modifications

- Funding medical or aged care costs

- Gifting money to children (e.g., helping them buy a home)

- Paying off existing debts

Negatives of a Reverse Mortgage

Unlike traditional loans where interest reduces as you make payments, a reverse mortgage’s interest compounds, meaning the debt grows quickly over time.

The loan and interest must be repaid when the property is sold, leaving less for beneficiaries.

Receiving a lump sum or regular payments from a reverse mortgage can affect eligibility for the Age Pension and other government benefits.

Borrowers may face:

- Establishment fees

- Ongoing service fees

- Valuation and legal fees

- Discharge costs when repaying the loan

If the loan grows too large, selling the home earlier than expected may become necessary to clear the debt.

Key Elements Borrowers Should Consider

1. How Much to Borrow?

Borrowing the minimum needed rather than the maximum can reduce compounding interest.

2. Interest Rate Type

Reverse mortgages typically have have higher rates than standard home loans. Comparing lenders and choosing fixed or variable rates can impact long-term costs.

3. Future Costs (Aged Care & Medical Expenses)

If borrowers use too much equity early, they might struggle to cover aged care costs later in life.

4. Alternative Financial Options

Before committing, borrowers should explore other financial solutions, such as:

- Downsizing to a smaller home

- Government support (e.g., pension loans scheme)

- Accessing superannuation funds

5. The Impact on Beneficiaries

A reverse mortgage can significantly reduce the value of an inheritance. Family members should be included in discussions about future financial plans.

Who Should Borrowers Speak With?

A reverse mortgage is a complex financial decision that requires advice from professionals, including:

1. Mortgage Brokers Specialising in Reverse Mortgages

Not all mortgage brokers are experienced with reverse mortgages. It’s important to work with a broker who:

- Understands the rules and lender policies

- Can explain interest rate structures and repayment conditions

- Helps compare lenders offering the best terms

- Is accredited to handle reverse mortgage products

2. Financial Planners

A financial planner can assess how a reverse mortgage impacts retirement income, pension eligibility, and long-term financial security.

3. Centrelink or Services Australia

To check whether borrowing will affect pension entitlements.

4. Solicitors or Legal Advisors

Legal professionals help ensure borrowers fully understand the contract terms, risks, and inheritance implications.

Why Not All Mortgage Brokers Are Equipped for Reverse Mortgages

Many mortgage brokers focus on standard home loans and investment lending. However, reverse mortgages have unique complexities, including:

- Higher compliance standards: Lenders require brokers to conduct detailed suitability assessments.

- Specialist knowledge needed: Not all brokers are trained in retirement lending solutions or understand Age Pension impacts.

- Fewer lender options: Only select lenders offer reverse mortgages, so a broker must have access to the right panel of lenders.

For these reasons, borrowers should seek a reverse mortgage specialist broker rather than a general mortgage broker.

Laws & Conditions Governing Reverse Mortgages in Australia

Reverse mortgages in Australia are regulated under the National Consumer Credit Protection Act 2009 (NCCP Act). Key protections include:

1. No Negative Equity Guarantee

- Borrowers (or their estate) cannot owe more than the home’s market value when sold.

2. Borrowing Limits Based on Age

- Lenders cap the maximum loan-to-value ratio (LVR) based on the borrower’s age (e.g., a 60-year-old may access 15-20% of home value, while an 80-year-old may access more).

3. Suitability & Financial Advice Requirements

- Lenders must ensure the borrower understands the product’s risks and alternatives.

- Some lenders require borrowers to obtain legal or financial advice before approval.

4. Homeowner Responsibilities

- The borrower must keep the home insured, maintained, and pay council rates.

Example Scenarios: How a Reverse Mortgage Can Be Used

Scenario 1: Gifting Money to Children Now

John (70) and Margaret (68) want to help their daughter buy her first home but don’t want to sell their own house. They take a $100,000 reverse mortgage and gift it to their daughter. The loan balance grows over time, but they understand this means reducing their inheritance.

Scenario 2: Funding Home Renovations

David (75) wants to install a wheelchair-friendly bathroom but lacks savings. He takes a $50,000 reverse mortgage, allowing him to modify his home and continue living independently.

Scenario 3: Covering Aged Care Costs

Mary (82) needs to move into aged care but wants to keep her home for a few years. She uses a reverse mortgage to pay for in-home care services until she’s ready to transition.

Final Thoughts

A reverse mortgage can be a powerful tool for retirees needing financial flexibility. However, it’s not suitable for everyone due to interest accumulation and its impact on inheritance. Seeking advice from specialist mortgage brokers, financial planners, and legal experts is essential before proceeding.

By understanding the risks, regulations, and best practices, borrowers can make informed decisions that align with their financial goals and family circumstances.

At Broker.com.au, we’re dedicated to helping business owners secure the best finance solutions to support their growth. Contact us anytime to see how we can assist you—call 1300 373 300 or email [email protected].

To explore more resources and gain insights into securing business loans and other financial solutions, visit our comprehensive Resources & Learning page.