As we enter the second quarter of 2025, Australia’s property market is navigating a complex landscape of economic uncertainty, inflationary pressures, housing undersupply, and shifting interest rate expectations. If you’re a home loan borrower—or considering entering the market—now is a critical time to understand what’s happening and how it may impact your mortgage and property values across the country.

Rising House Prices Despite High Interest Rates

Despite the Reserve Bank of Australia (RBA) holding rates high to manage inflation, CoreLogic’s national Home Value Index (HVI) rose 0.6% in April 2025. This marks a continuation of growth driven largely by a persistent lack of housing supply across most states and territories.

According to CoreLogic, some of the strongest housing markets right now are in Queensland and Western Australia. Brisbane suburbs like Springfield Lakes and Coorparoo have experienced growth as high as 17% and 6.7% respectively since early 2024, while parts of Perth have seen annual price jumps exceeding 20% due to strong population growth and limited stock (https://trade.wileydirect.com.au/2025/02/14/australian-property-forecast-2025-the-insider-scoop-from-an-award-winning-buyers-agent/) (https://www.corelogic.com.au/news-research/news/2024/housing-values-rise-0.6-in-april,-as-low-supply-trumps-high-interest-rates-and-inflation).

The Undersupply Issue: What It Means for Buyers and Borrowers

Australia is currently facing a significant housing shortfall — estimated at more than 100,000 dwellings by 2028. Despite this, certain markets like Melbourne are experiencing price stagnation or even small declines. This is largely due to localised oversupply in some areas and investor retreat, particularly in Victoria, where rental stock has dropped to its lowest level since records began (https://www.abc.net.au/news/2025-01-02/corelogic-property-prices-national-drop-2024-wrap/104773908)(https://www.corelogic.com.au/news-research/news/2024/if-housing-is-so-undersupplied-why-are-some-markets-falling-in-value).

The undersupply of new builds, paired with strong migration and population growth, means property values are likely to stay elevated even if interest rates remain higher for longer. For borrowers, this makes timing your entry into the market crucial—waiting for prices to fall might not be a winning strategy.

Interest Rates, Inflation, and RBA Forecasts

The latest RBA inflation reading from April 2025 showed a slight decline but still sits above the target 2–3% band. While many economists forecast rate cuts beginning later in the year—possibly in May—there remains uncertainty. Global geopolitical developments, such as potential trade disruptions tied to Donald Trump’s return to the U.S. political scene and his proposed tariff regime, could affect global inflation and, in turn, influence the RBA’s decisions.

Australia’s major banks are forecasting different outcomes:

- Commonwealth Bank and ANZ expect the cash rate to fall to around 3.35% by the end of 2025.

- Westpac is more conservative, predicting only one or two cuts this year.

- NAB projects similar moderation, with cuts likely only if inflation continues to cool.

If rate cuts occur, home loan borrowers could see some relief—especially those on variable rates—but competition for housing is expected to keep prices firm in most regions.

The Federal Election and What It Means for Homeowners

Australia’s upcoming federal election adds another layer of uncertainty. A Labor government is likely to continue focusing on housing supply incentives and rental reforms. Their top three property-related priorities are:

- Expanding the Housing Australia Future Fund to accelerate social housing.

- Encouraging institutional investment in build-to-rent.

- Supporting first-home buyer schemes.

A Liberal government, on the other hand, may:

- Reintroduce or expand negative gearing incentives for investors.

- Advocate for supply-side reforms by reducing planning restrictions.

- Push tax relief to encourage private home ownership.

For home loan borrowers, Labor’s approach may keep interest rates slightly lower due to government-backed programs, while Liberal policies may drive more investor demand, putting upward pressure on prices.

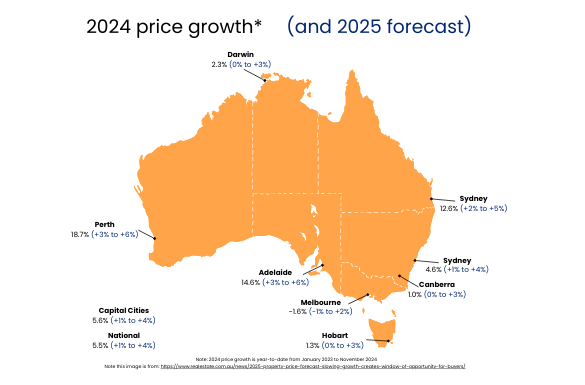

What’s Happening State-by-State?

- NSW: Sydney remains a high-demand market, with strong price resilience due to limited land and slow construction approvals.

- VIC: Melbourne is facing a temporary dip, offering possible bargains for long-term buyers. Oversupply in some areas is offsetting broader housing shortages.

- QLD: Brisbane and coastal areas like Noosa continue to surge. Supply issues and migration are key drivers.

- WA: Perth is experiencing rapid growth but is considered by some experts to be nearing its peak.

- SA & TAS: Adelaide remains strong thanks to affordability, while Tasmania shows modest growth, driven by lifestyle migration.

- ACT: Canberra’s market is stabilising, with fewer fluctuations but steady rental demand.

- NT: Darwin remains volatile, with investor demand and employment opportunities driving swings.

Why You Should Speak to a Home Loan Broker Now

With inflation trends, interest rate speculation, a federal election, and housing undersupply all colliding in 2025, navigating the home loan landscape on your own is riskier than ever.

A professional home loan broker can:

- Compare dozens of lenders to find the most competitive rates.

- Advise on fixed vs variable interest rate strategies based on market trends.

- Help you secure pre-approval to move quickly in fast-moving markets.

- Assist first-home buyers with government schemes and deposit options.

- Support refinancing decisions to reduce repayment stress.

If you’re thinking about buying your first home, investing, or refinancing in 2025, now is the time to get expert help from a home loan broker. We understand the complexity of the market and can tailor your mortgage strategy to current economic conditions and your long-term goals.

At Broker.com.au, we are helping home owners with mortgages save significant amounts on their monthly repayments. And for first home buyers, there are many first home buyer incentives that our team can help with.

Get in touch with broker.com.au today to make smart decisions in a challenging market. Whether you’re navigating high rates, planning for rate cuts, or trying to get into an undersupplied market, professional guidance can make all the difference.

At Broker.com.au, we help you navigate Australia’s property market with expert mortgage advice tailored to current conditions. Whether you’re buying your first home, investing, or refinancing, our brokers are here to guide you every step of the way. Contact us today at 1300 373 300 or [email protected]. For more tips, visit our Resources & Learning page.