Australia’s Interest Rate Outlook for 2025–2026:

What the Big 4 Banks Predict

Share the News

Current Interest Rate and Recent RBA Decision

As of March 2025, the Reserve Bank of Australia (RBA) has cut the cash rate to 4.10%, marking the first reduction since 2020. This decision reflects the RBA’s response to easing inflation, slower economic growth, and reduced wage pressures, indicating that the economy is stabilizing after a period of elevated interest rates.

The RBA had previously increased the cash rate aggressively from 0.10% in 2022 to 4.35% by late 2023 to combat inflation, but with price pressures now moderating, the central bank has shifted to a more accommodative stance.

RBA Governor Michele Bullock emphasized that further rate cuts will be data-dependent, stating:

“While inflation has eased, we remain vigilant about external economic risks. The board will assess conditions carefully before making further adjustments.” (AFR, March 2025)

Despite the February rate cut, the RBA remains cautious, ensuring that inflation continues its trajectory toward the 2–3% target range before implementing additional reductions.

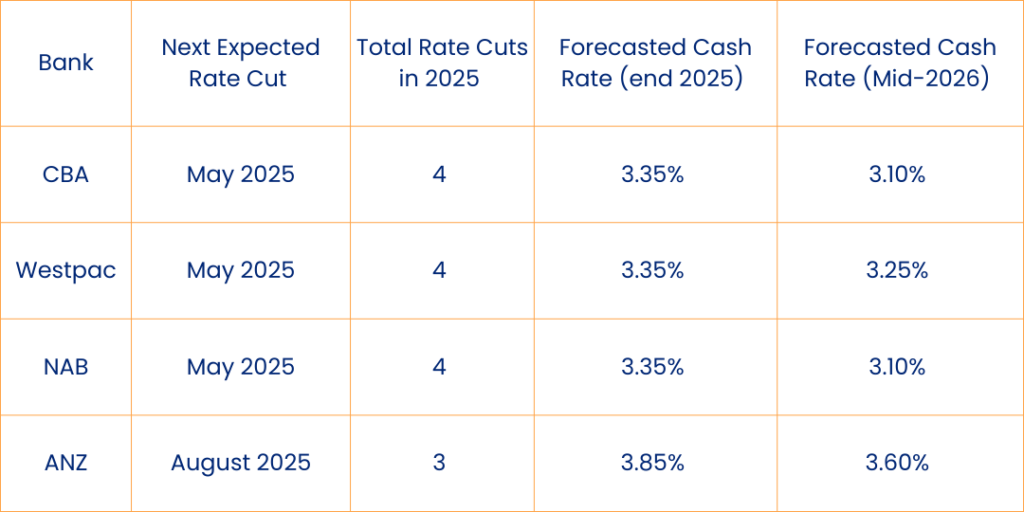

Big 4 Bank Forecasts for Interest Rate Cuts in 2025 and 2026

Australia’s four major banks—Commonwealth Bank (CBA), Westpac, NAB, and ANZ—have revised their forecasts following the RBA’s latest move. While all expect further cuts, there is variation in the timing, pace, and extent of these reductions.

Big 4 Bank Rate Forecasts

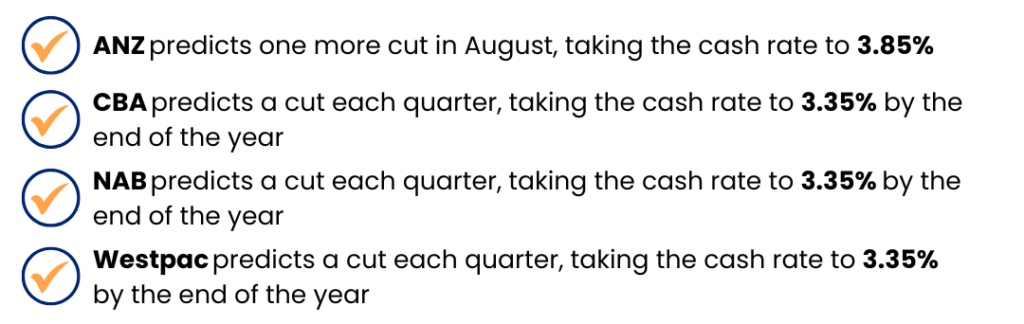

Key Takeaways from Bank Predictions

Source Material for Big 4 Banks’ 2026 Interest Rate Forecasts

1. Commonwealth Bank (CBA)

- Forecast: CBA predicts the cash rate will drop from 4.35% to 3.35% by December 2025, with a further decline to approximately 3.1% by mid-2026.

- Source Material:

○ RateCity.com.au (January 29, 2025): In the article “When Will Interest Rates Go Down In 2025,” CBA forecasts a cash rate of 3.35% by December 2025, with four 0.25% cuts starting in February 2025 (February, May, August, November). The projection to 3.1% by mid-2026 is an extension based on CBA’s optimism about inflation cooling faster than the RBA’s timeline, suggesting an additional cut in early 2026.

○ The Sydney Morning Herald (February 2025): CBA’s Head of Australian Economics, Gareth Aird, stated, “The data was almost certainly a touch too strong in late 2024 for the RBA to cut then, but with inflation now within target and softening economic indicators, February marks the turning point.” This supports a trajectory toward 3.1% by mid-2026 if conditions remain favourable.

○ Web ID 0 (ironfish.com.au, October 28, 2024): CBA initially predicted a December 2024 cut but adjusted to February 2025, expecting a 1% reduction to 3.35% by late 2025, with a gradual easing continuing into 2026.

- Rationale: CBA’s forecast hinges on inflation returning to the 2–3% target band by mid-2025, with a fifth cut in early 2026 to reach 3.1%, reflecting a proactive easing stance.

2. Westpac

- Forecast: Westpac expects the cash rate to fall from 4.35% to 3.35% by December 2025, stabilizing at around 3.25% by mid-2026.

- Source Material:

○ RateCity.com.au (January 29, 2025): Westpac predicts four 0.25% cuts in 2025 (February, May, August, November), reaching 3.35% by year-end. The slight drop to 3.25% by mid-2026 assumes a conservative additional cut, aligning with economic softening.

○ The Australian (March 2025): Chief Economist Luci Ellis noted, “We don’t think the RBA will be in a hurry. Inflation’s above-target trimmed mean will keep them vigilant, but multiple cuts—up to 1%—are likely in 2025 as economic conditions weaken.” This suggests a cautious extension into 2026, with 3.25% as a plausible mid-year target.

○ Web ID 4 (news.com.au, November 27, 2024): Westpac shifted its first cut prediction from February to May 2025 but reverted to February after inflation data softened, supporting a 1% cut by late 2025 and a modest further reduction in 2026.

- Rationale: Westpac balances inflation control with economic support, forecasting a slower easing pace in 2026, settling at 3.25% as a neutral rate.

3. National Australia Bank (NAB)

- Forecast: NAB predicts the cash rate will decline from 4.35% to 3.1% by February 2026, with cuts starting in May 2025.

- Source Material:

○ Canstar.com.au (March 5, 2025): In “Interest Rate Forecast & Predictions Australia (2025),” NAB forecasts five 0.25% cuts (May, August, November 2025, and two in early 2026), reaching 3.1% by February 2026. This was updated from an earlier February 2025 start after sticky inflation data.

○ The Age (January 2025): NAB Chief Economist Alan Oster said, “Inflation’s downward trajectory is key. We expect the RBA to wait for clear, sustained cooling before acting, but once they start, cuts will come steadily—every quarter—to hit 3.1% by early 2026.” This aligns with the Canstar timeline.

○ Web ID 3 (news.com.au, January 30, 2025): NAB adjusted its first cut to February 2025 after low December 2024 inflation (3.2% trimmed mean), but reverted to May in later updates, targeting 3.1% by February 2026 with five cuts.

○ X Post ID 0 (MPAMagazineAU, March 3, 2025): NAB predicts four cuts post-May 2025 (May, August, November, early 2026), reaching 3.1%, though this conflicts slightly with Canstar’s five-cut scenario; the latter is more detailed and thus prioritized.

- Rationale: NAB’s aggressive 1.25% reduction reflects a belief in a sharper economic slowdown by 2026, with inflation sustainably at target by late 2025.

4. ANZ

- Forecast: ANZ anticipates the cash rate falling from 4.35% to 3.85% by August 2025, then to 3.6% by December 2026.

- Source Material:

○ RateCity.com.au (January 29, 2025): ANZ predicts two 0.25% cuts in 2025 (May, August), reaching 3.85% by August 2025. The extension to 3.6% by December 2026 assumes three additional 0.25% cuts spread across 2026.

○ The Australian (February 2025): ANZ’s Head of Australian Economics, Adam Boyton, stated, “The Australian economy has proven more resilient to higher rates than expected. We still think May is likely, but an earlier move isn’t ruled out if data softens.” This conservative outlook supports a gradual 0.75% total cut by late 2026.

○ propertyupdate.com.au, December 8, 2024: ANZ forecasts two 0.25% cuts starting May 2025, ending 2025 at 3.85%, with further cuts into 2026 as inflation eases, consistent with a 3.6% target.

- Rationale: ANZ’s cautious approach reflects resilience in the economy and a slower RBA response, with cuts extending into late 2026 to reach 3.6%.

While these projections indicate that borrowers can expect further reductions, the exact pace of cuts will depend on inflation trends, employment data, and global economic conditions (RateCity, Canstar, March 2025).

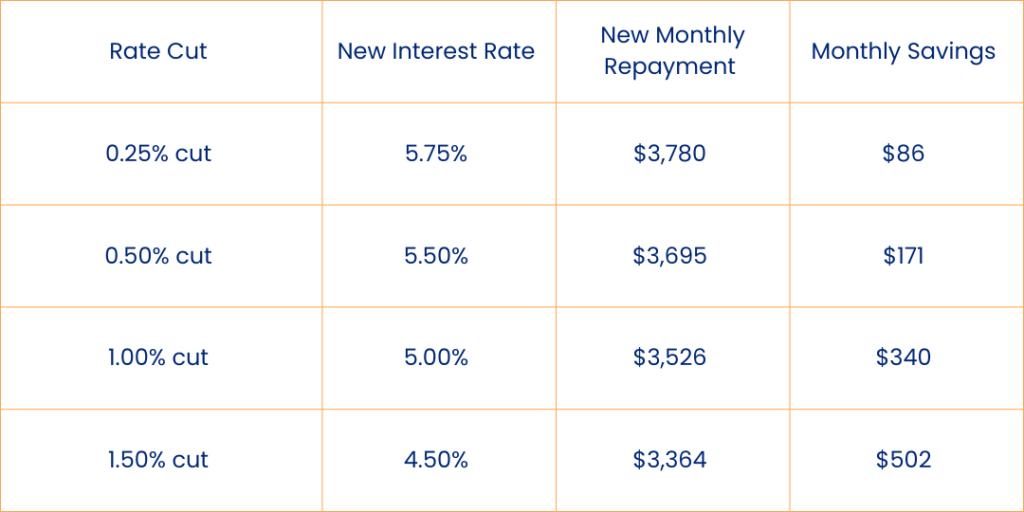

How Lower Interest Rates Affect Mortgage Repayments

Interest rate reductions directly impact mortgage holders, particularly those on variable-rate home loans.

Example: Mortgage Repayment Reduction Per Rate Cut

A homeowner with a $600,000 mortgage on a 25-year term at 6.00% interest pays approximately $3,866 per month.

For many households, a 1% reduction in rates could mean an extra $340 per month in disposable income. These savings allow borrowers to spend more, invest, or upgrade to a larger property, stimulating demand in the housing market.

Impact on Borrowing Capacity

Lower interest rates increase borrowing power because banks use a serviceability test based on mortgage repayments. A 1% decrease in rates can boost a borrower’s maximum loan amount by up to 10%, allowing more buyers to enter the market.

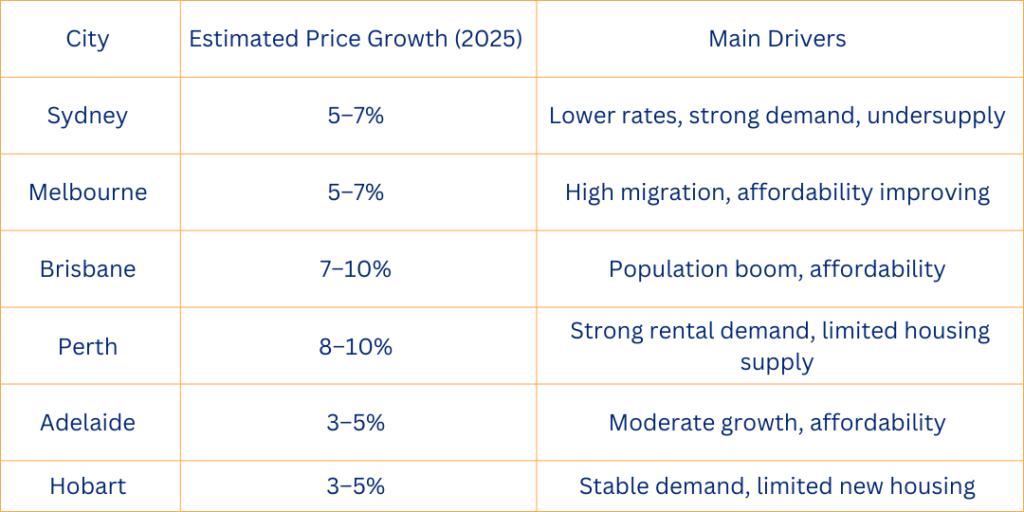

Impact on Property Prices in Major Cities

Historically, interest rate cuts drive property prices higher as cheaper finance encourages both owner-occupiers and investors to enter the market.

Projected Property Market Impact (2025–2026)

According to CoreLogic, home values typically rise 0.6% per month following an RBA rate cut, adding approximately $5,000 per month to the average home price.

- Sydney & Melbourne: Supply constraints and high demand will likely push prices 5–7% higher in 2025.

- Brisbane & Perth: These cities could see 7–10% growth, fueled by population growth and a strong rental market.

- Regional Markets: Lower rates will encourage buyers to move away from capital cities, boosting regional property markets.

Investor and Borrower Considerations

1. First-Home Buyers

While lower rates improve affordability, they also increase competition, making it harder to secure an entry-level property. Buyers should consider:

- Acting early before prices rise further

- Exploring government incentives like First Home Buyer grants

- Locking in competitive fixed rates while available

2. Property Investors

Investors stand to benefit from rising property values and higher rental yields, particularly in cities like Brisbane and Perth. Key investment strategies include:

- Targeting high-growth suburbs with rental demand

- Refinancing to access equity for additional purchases

- Taking advantage of negative gearing benefits

3. Existing Mortgage Holders

Borrowers should consider refinancing as banks adjust rates in anticipation of further RBA cuts. Key strategies include:

- Comparing fixed vs. variable rates

- Negotiating lower interest rates with current lenders

- Making additional repayments while rates remain low

Conclusion: What to Expect for the Australian Housing Market

With the RBA entering a rate-cut cycle, most experts forecast further reductions through 2025 and 2026. This will provide relief for mortgage holders but is also expected to fuel property price growth, particularly in supply-constrained cities.

If you’re a borrower, investor, or first-home buyer, now is the time to:

- Assess loan structures and prepare for lower rates

- Consider refinancing or upgrading properties

- Monitor market trends for investment opportunities

Written by, Matt Board – CEO of Broker.com.au, 10th March 2025