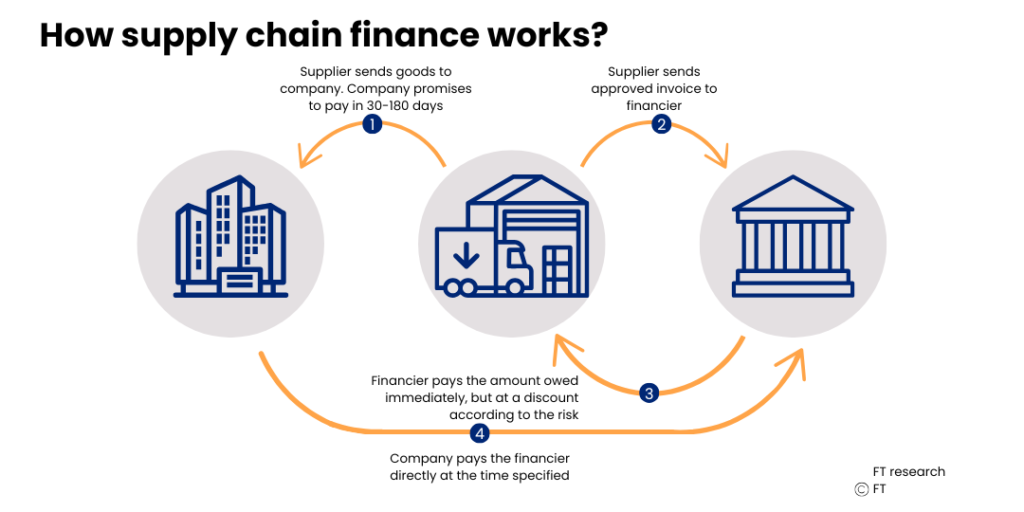

This is facilitated by a financial institution or SCF provider, which bridges the gap between the buyer and supplier, enabling both to improve their working capital positions.

Benefits of Supply Chain Finance for Buyers and Suppliers

1. For Buyers:

- Extended Payment Terms: SCF allows buyers to negotiate longer payment terms without affecting the supplier’s cash flow, improving the buyer’s own liquidity.

- Stronger Supplier Relationships: With SCF, buyers can support suppliers’ cash flow needs, which enhances relationships and may lead to better supplier terms or preferential treatment.

2. For Suppliers:

- Early Payment Access: Suppliers can get paid sooner, improving their cash flow and reducing the need for other financing solutions like high-interest loans.

- Reduced Risk of Late Payment: By engaging in SCF, suppliers minimize their risk exposure, as payment often comes from a financial institution rather than waiting for the buyer.

Example of How Businesses Use Supply Chain Finance

Imagine a large retailer that negotiates to extend payment terms from 30 days to 90 days to improve its cash flow. Without SCF, this delay could strain the supplier’s finances. However, by using SCF, the supplier has the option to receive payment as early as the original 30-day term, facilitated by a finance provider. The retailer benefits from extended terms, while the supplier’s cash flow remains uninterrupted—maintaining a positive supplier relationship.

Supply Chain Finance and Risk Management

1. For Suppliers: SCF reduces risk by providing a predictable cash flow. Early payment options mean suppliers can reduce dependency on uncertain payments from buyers, especially useful in volatile market conditions.

2. For Buyers: SCF mitigates risks by strengthening supplier stability. When suppliers have better cash flow, they are less likely to suffer disruptions that could affect production or delivery timelines.

Situations to Consider Supply Chain Finance

Businesses might consider SCF in scenarios like:

- When payment terms need to be extended without impacting supplier stability.

- High-growth or seasonal periods where cash flow is under pressure.

- In volatile markets where maintaining a steady supply chain is critical.

- When engaging new suppliers and wanting to build stronger relationships by offering early payment options.

Deciding if Supply Chain Finance is Right for Your Business

To determine if SCF is a good fit:

- Analyse Cash Flow Needs: Assess your working capital cycle and cash flow demands. If extended payment terms would improve your liquidity but impact suppliers, SCF could be beneficial.

- Consider Supplier Relationships: If maintaining strong supplier partnerships is crucial to your business, SCF can offer stability and goodwill.

- Evaluate Your Supply Chain Risk Profile: If your industry is prone to supply chain disruptions, SCF can mitigate risk by supporting suppliers financially.

Choosing a Finance Partner (e.g., Octet): Key Considerations

1. Transparency and Flexibility: Look for a partner that provides transparent terms and offers flexible financing solutions tailored to your needs.

2. Industry Experience and Knowledge: Choose a finance partner with experience in your industry or supply chain dynamics. Knowledge of specific industry challenges can make a significant difference in service quality and efficiency.

3. Technology and Integration Capabilities: Many SCF providers offer digital platforms that integrate with your systems for seamless transaction management. Ensure the provider’s platform meets your operational needs.

4. Service and Support: Strong customer support is essential, as SCF can be complex to implement. A partner with a dedicated team for support and guidance can add value to the relationship.

In summary, supply chain finance is an excellent tool for businesses looking to balance cash flow needs with healthy supplier relationships. By choosing a knowledgeable finance partner and carefully evaluating business needs, companies can optimize their working capital and strengthen their supply chains.

To learn more about supply chain finance and other financial solutions, visit our Resources & Learning page for helpful resources.

Broker.com.au is here to guide you through the process. Reach out today!