These loans are commonly sought by self-employed individuals, freelancers, contractors, or small business owners who have irregular income or lack conventional proof of earnings.

What is a Low Doc Home Loans?

A low doc home loans (short for low documentation loan) is a type of mortgage designed for borrowers who may not have access to traditional financial documentation, such as full tax returns or payslips. These loans are commonly sought by self-employed individuals, freelancers, contractors, or small business owners who have irregular income or lack conventional proof of earnings.

Who Are Low Doc Home Loans For?

Low doc home loans are ideal for:

- Self-employed individuals who cannot provide complete financial documentation.

- Freelancers and contractors with irregular income streams.

- Small business owners without up-to-date financial statements.

- Investors with alternative income sources but lacking traditional proof.

Examples of Low Doc Home Loans

- Low doc home loans for property purchase: For self-employed individuals buying residential property.

- Low doc investment loans: Designed for property investors with alternative income verification methods.

- Low doc refinance loans: For borrowers wanting to refinance existing loans without traditional financial documentation.

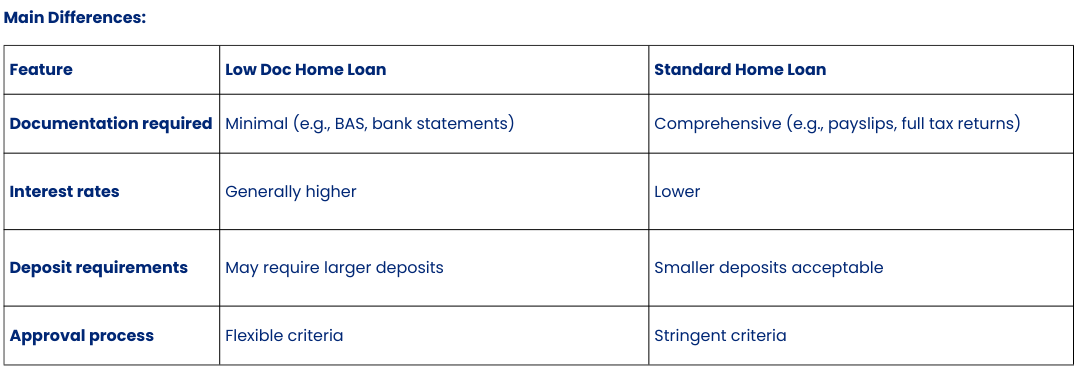

Low Doc Home Loans vs Standard Home Loans

Advantages of Low Doc Loans:

- Tailored for borrowers with unconventional income.

- Streamlined application process.

- Flexibility in income verification.

Disadvantages of Low Doc Loans:

- Higher interest rates and fees.

- Larger deposit requirements.

- Limited availability of lenders offering these loans.

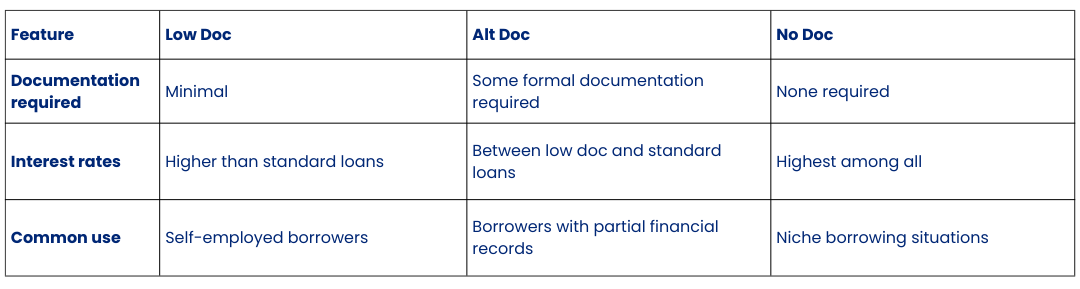

Low Doc vs Alt Doc vs No Doc Home Loans

How to Apply for a Low Doc Home Loan

1. Book a Consultation with a Home Loan Specialist or Mortgage Broker

A professional broker or home loan specialist can assess your financial situation and recommend suitable low doc home loan options. They’ll explain lender requirements, assist with income verification, and guide you through the lending process. Brokers often have access to a wide range of lenders, including those catering to self-employed borrowers, helping you secure competitive terms even if your financial documents are unconventional.

2. Submit an Application Form

The application form is a detailed record of your personal and financial information, including property details and loan requirements. A broker or lender will help you complete this form accurately, ensuring all fields are filled out and aligned with the lender’s criteria. Double-checking the form for errors can help prevent delays in approval.

3. Provide Supporting Documents

Supporting documents establish your identity and verify your income. Gather essential records such as proof of identity, business bank statements, and tax-related documents. Presenting well-organized documentation can streamline the lender’s assessment process and increase your chances of approval.

4. Property Valuation and Contract of Sale

Once your application is under review, the lender will arrange a property valuation to ensure the asset matches the loan amount. You’ll also need to submit the contract of sale if purchasing a property. This step confirms the property’s market value and legitimacy, finalizing the loan amount and repayment structure.

Documents Needed for a Low Doc Home Loan

- Proof of ID (passport, driver’s licence)

- Most recent personal tax return and Notice of Assessment (NOA)

- Business tax return or statement

- Business bank account statements

- Proof of ABN and GST registration

- PAYG payment summary or ‘tax ready’ income documentation

- Business Activity Statements (BAS)

- Financial statements prepared by an accountant

Low Doc Home Loan Features That Save Money

- Flexible Repayment Options: Many self-employed borrowers experience fluctuating income. Having the option to make large lump-sum repayments without penalties can help reduce the loan balance faster and save on interest.

- Redraw Facilities: A redraw facility allows borrowers to withdraw extra repayments they’ve made if they need funds. This feature offers financial flexibility while reducing interest when extra payments are made.

- Offset Accounts: An offset account links a savings or transaction account to your home loan, reducing the amount of interest charged. The savings in the offset account effectively lower the interest-bearing principal, which can result in substantial savings over the loan term.

Broker.com.au can help you navigate a low doc loan application. Reach out to us today!

To learn more about low-doc home loans and how they can benefit you, visit our Resources & Learning page.