Why More Australians Are Turning to SMSFs to Build Future Wealth, Especially with Property Investments

The flexibility to control investments, particularly in property, and dissatisfaction with the performance of traditional industry super funds are driving this trend. This article delves into the reasons for the shift, SMSF structures, asset classes, and the long-term benefits of investing in property.

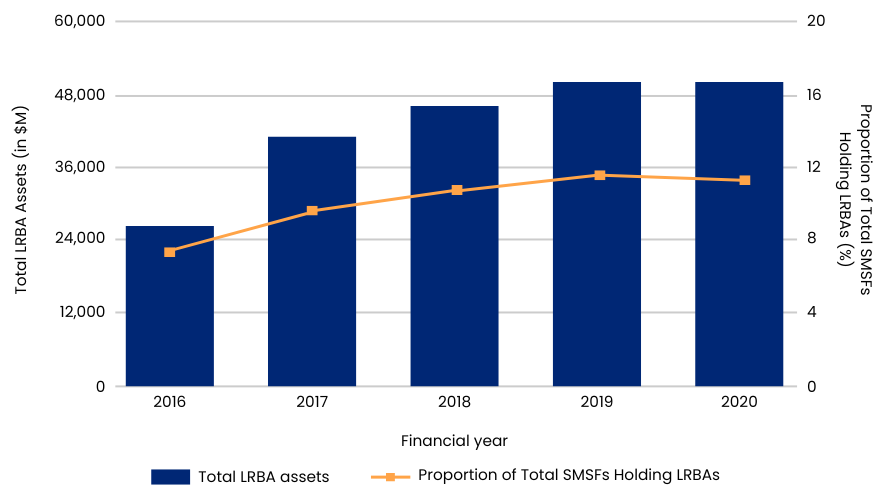

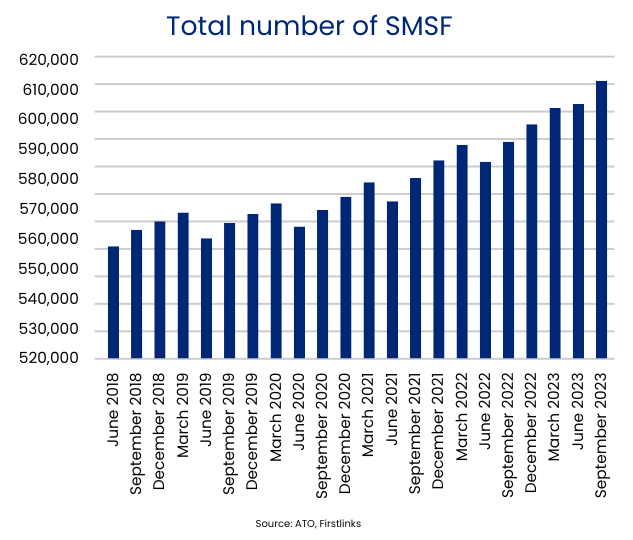

Growth of SMSFs and Property Investments

The Australian Taxation Office (ATO) reports a steady increase in SMSFs over recent years, with a notable rise in property investments within these funds. In the five years leading up to 2023, the value of residential properties held in SMSFs grew by 15%, while non-residential properties (commercial real estate) saw an even larger increase of 21%. This reflects the growing appeal of property as a stable, long-term investment choice for wealth accumulation in SMSFs.

Underperformance of Industry Super Funds

Data from the Australian Prudential Regulation Authority (APRA) indicates a growing disparity between SMSFs and industry super funds. Many industry funds underperformed in the past decade, particularly during periods of market volatility. APRA’s statistics highlight that SMSFs provide trustees with the ability to customise investment strategies, which can be tailored to mitigate risks and capitalise on high-performing asset classes, such as property and equities.

Asset Classes in SMSFs

SMSFs offer a wide range of investment options, including:

- Direct Property: Both residential and commercial properties.

- Equities: Domestic and international shares.

- Fixed Interest and Cash: Bonds, term deposits, and savings accounts.

- Collectibles and Other Investments: Artwork and precious metals (subject to regulations).

This diversification ensures that SMSFs can be tailored to meet specific financial goals and risk tolerances.

Property: A Preferred Asset Class

Investing in property through an SMSF provides several advantages:

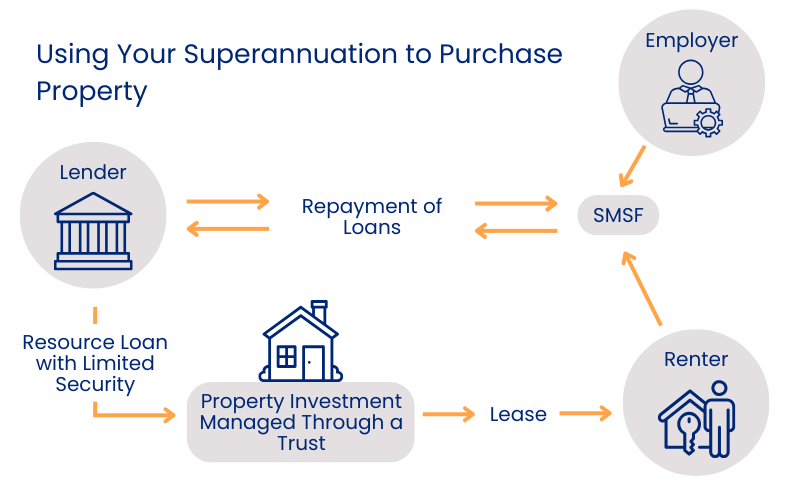

- Leverage with Limited Recourse Borrowing Arrangements (LRBAs): SMSFs can borrow to purchase property, with lenders having recourse only to the asset securing the loan. This limits the risk exposure for the rest of the fund’s assets.

- Stable Growth: Property investments, particularly in Australia, have demonstrated consistent long-term capital appreciation.

- Tax Efficiency: Rental income and capital gains are taxed at concessional rates, further enhancing the appeal of property investments in SMSFs.

Comparison of Performance Across Asset Classes

When comparing property with other asset classes such as equities, the stability and tangible nature of property often provide trustees with a sense of security. Equities can offer higher returns in the short term but are subject to market volatility. Property, by contrast, is less susceptible to sudden market swings and often provides consistent rental income.

Key Considerations for SMSF Property Investment

- Trust Deed Compliance: Ensure the trust deed allows property investment and adheres to the sole purpose test of providing retirement benefits.

- Funding and Borrowing: Understand LRBAs and ensure sufficient liquidity to cover ongoing expenses.

- Diversification: Avoid over-concentration in property to mitigate risk.

- Regulatory Compliance: Adhere to strict ATO regulations regarding related-party transactions and investment strategy reviews.

Long-Term Benefits of Property Investment in SMSFs

Property offers a hedge against inflation and delivers consistent income, making it a reliable long-term wealth-building strategy. Australia’s robust property market, combined with favourable tax settings in SMSFs, makes property a cornerstone for many trustees seeking growth and stability in their retirement portfolios.

Conclusion

The rise of SMSFs reflects Australians’ desire for greater control over their financial future. By investing in property and leveraging the flexibility of SMSFs, individuals can build robust retirement savings while tailoring their investment strategies to meet their unique goals. However, careful planning, compliance with regulations, and professional advice are essential to maximise the benefits of SMSF property investments.

For more details on SMSF regulations and property investment trends, visit the ATO and APRA websites.

Discover more strategies for growing wealth and achieving financial independence by visiting our Resources & Learning page.