The Australian financial landscape offers a variety of lending options tailored to diverse business needs, each with specific eligibility criteria and application processes. Understanding these options and the associated requirements is essential for businesses to successfully obtain financing.

Understanding Business Loans in Australia

A business loan is a financial product designed to provide capital to businesses for various purposes, including startup costs, expansion, equipment purchases, and managing cash flow. In Australia, business loans are offered by a range of financial institutions, including traditional banks, credit unions, and non-bank lenders.

Types of Business Loans

- Secured Business Loans: These loans require collateral, such as property or equipment, which the lender can claim if the loan is not repaid. Secured loans typically offer lower interest rates due to the reduced risk to the lender.

- Unsecured Business Loans: These do not require collateral but may come with higher interest rates and stricter eligibility criteria, reflecting the increased risk to the lender.

- Business Lines of Credit: This flexible financing option allows businesses to access funds up to a predetermined limit, paying interest only on the amount drawn.

- Equipment Financing: Specifically designed for purchasing business equipment, the equipment itself often serves as collateral for the loan.

- Invoice Financing: Also known as factoring, this allows businesses to borrow against outstanding invoices, providing immediate cash flow based on receivables.

- Merchant Cash Advances: A lump-sum payment to a business in exchange for a percentage of future sales, typically suitable for businesses with high credit card sales volumes.

Eligibility Criteria

Lenders assess several factors when evaluating business loan applications:

- Creditworthiness: Both the business’s and the owner’s credit histories are scrutinized to gauge reliability in repaying debts.

- Business Tenure: Established businesses with a track record are often viewed more favorably. Startups may face more stringent requirements or need to provide additional documentation.

- Financial Statements: Up-to-date financial records, including profit and loss statements, balance sheets, and cash flow statements, are essential to demonstrate the business’s financial health.

- Business Plan: A comprehensive plan outlining the business model, market analysis, and financial projections can strengthen a loan application.

- Collateral: For secured loans, lenders will assess the value and quality of the assets offered as security.

Application Process

- Preparation: Gather all necessary documentation, including financial statements, tax returns, business plans, and identification documents.

- Research: Compare loan products from various lenders to find terms that best suit your business needs.

- Application Submission: Complete the lender’s application form, providing accurate and comprehensive information to avoid delays.

- Assessment: The lender will evaluate your application, which may involve credit checks and verification of provided information.

- Approval and Funding: If approved, the lender will present a loan offer detailing the terms. Upon acceptance, funds are disbursed as agreed.

Interest Rates and Fees

Interest rates on business loans in Australia vary based on factors such as loan type, amount, term, and the creditworthiness of the applicant. Secured loans generally offer lower rates compared to unsecured loans. It’s crucial to also consider associated fees, including application fees, ongoing service fees, and potential early repayment penalties.

Government Support and Regulations

The Australian government provides various programs to support businesses in obtaining finance, such as the SME Recovery Loan Scheme, which encourages lenders to provide credit to small and medium enterprises. Additionally, regulatory bodies like the Australian Securities and Investments Commission (ASIC) oversee lending practices to ensure transparency and fairness in the financial sector.

Alternative Financing Options

Beyond traditional loans, Australian businesses might consider:

- Grants and Subsidies: Government grants are available for specific industries or purposes but often come with strict eligibility criteria.

- Equity Financing: Involves raising capital by selling shares of the business to investors, which doesn’t require repayment but does dilute ownership.

- Crowdfunding: Raising small amounts of money from a large number of people, typically via online platforms, suitable for startups or creative projects.

Challenges and Considerations

- Approval Rates: Not all loan applications are approved. Understanding the reasons for rejection can help in improving future applications.

- Debt Management: Taking on a loan increases financial obligations. It’s essential to assess the business’s ability to meet repayments to avoid financial strain.

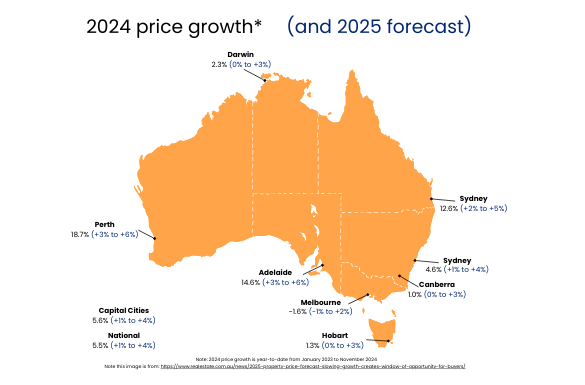

- Market Conditions: Economic factors can influence interest rates and lending terms. Staying informed about market trends is beneficial.

Tips for a Successful Loan Application

- Maintain Accurate Records: Up-to-date and accurate financial records build credibility with lenders.

- Demonstrate Stability: Show consistent business performance and a clear plan for future growth.

- Seek Professional Advice: Consult with financial advisors or accountants to strengthen your application and choose the most suitable loan product.

Conclusion

Securing a business loan in Australia involves careful preparation, understanding of the financial landscape, and a clear presentation of your business’s strengths and needs. By thoroughly researching options, maintaining robust financial records, and seeking professional guidance, businesses can enhance their chances of obtaining the necessary funding to achieve their objectives.

There are many moving parts to securing a business loan in Australia. Reach out to our team who are well equipped to guide you through this process: email us at [email protected] or phone 1300 373 300.

To explore more resources and expand your knowledge about securing business loans and other financial solutions, visit our comprehensive Resources & Learning page.