1. Introduction to Chattel Mortgages

A chattel mortgage is a popular financing option in Australia used primarily for purchasing business-related assets like vehicles or equipment. Unlike traditional home mortgages, which are secured against real property, a chattel mortgage is secured against movable personal property, or “chattel.” Under a chattel mortgage arrangement, the borrower gains ownership of the asset at the time of purchase, while the lender holds a mortgage interest in it until the loan is repaid in full.

Chattel mortgages are particularly useful for businesses looking to acquire essential assets while managing cash flow effectively, as they offer several tax benefits and flexible repayment options.

2. When Are Chattel Mortgages Typically Used?

Chattel mortgages are commonly used in the following scenarios:

- Vehicle and Equipment Financing for Businesses: Many Australian businesses use chattel mortgages to finance vehicles, machinery, and equipment. This type of financing is ideal for assets with high value that are essential to operations but would require significant capital outlay to purchase outright.

- Businesses Registered for GST: Chattel mortgages offer GST advantages. Businesses registered for GST on a cash basis can claim the GST paid on the purchase price of the asset, making it particularly appealing for those who need high-cost equipment.

- Low Doc or Full Doc Loans: Chattel mortgages are available for businesses that prefer either “low doc” loans, where minimal documentation is required, or “full doc” loans for borrowers with thorough financial records. This flexibility makes them accessible to a wider range of businesses.

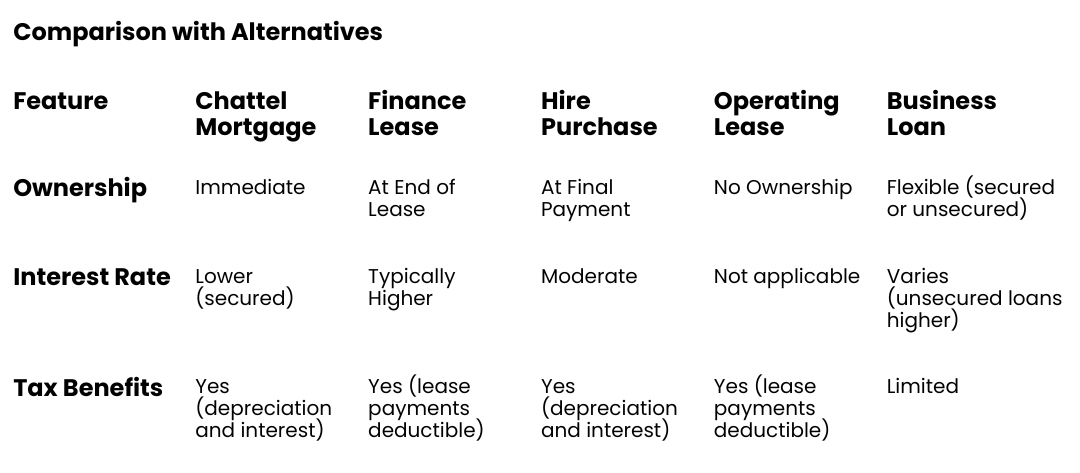

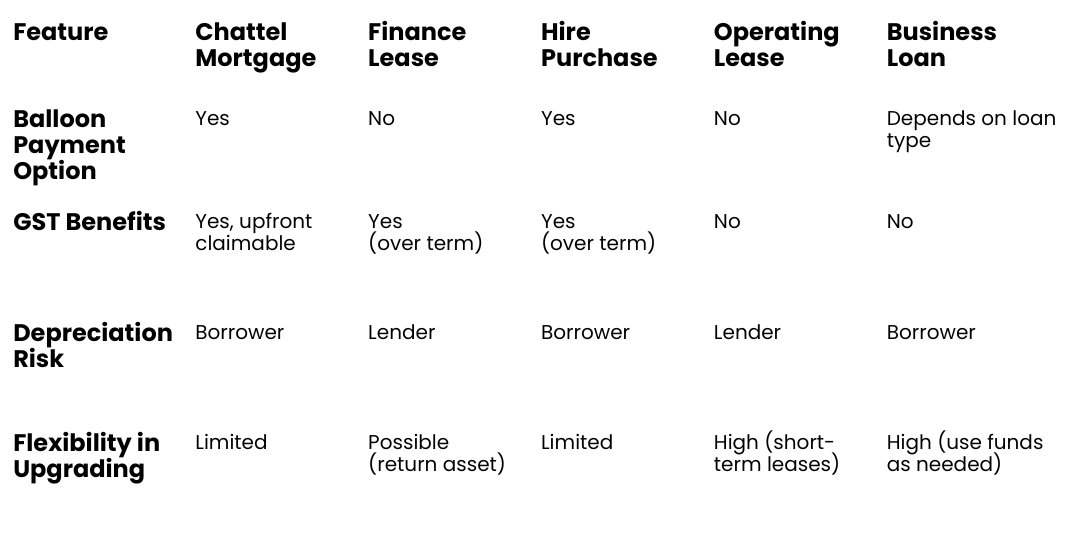

3. Alternatives to Chattel Mortgages

There are several alternative financing options to chattel mortgages that businesses in Australia may consider, including:

- Finance Lease: With a finance lease, the lender purchases the asset and leases it to the business. The business does not own the asset but has the right to use it over the lease period. At the end of the lease, the business may have the option to buy the asset, return it, or continue leasing.

- Hire Purchase: In a hire purchase arrangement, the business hires the asset and makes payments over a set term, similar to a chattel mortgage. Ownership transfers only after the final payment is made, unlike a chattel mortgage, where the borrower has ownership from the start.

- Operating Lease: Operating leases are short-term leases where the asset is returned to the lender at the end of the lease period. It is ideal for businesses needing equipment that may become outdated quickly and don’t want ownership responsibilities.

- Business Loan (Unsecured or Secured): Traditional business loans can be used to purchase assets. Unlike chattel mortgages or leases, a business loan provides funds without directly tying the loan to a specific asset as security, though it may still require collateral.

4. Advantages and Disadvantages of Chattel Mortgages versus Alternatives

To better understand the suitability of chattel mortgages, let’s compare their pros and cons against the alternative options.

Advantages of Chattel Mortgages

1. Immediate Ownership

- With a chattel mortgage, the borrower owns the asset from day one, which can be advantageous for businesses that want control over their assets immediately. In contrast, with leases and hire purchase agreements, ownership typically transfers only after final payments.

2. Tax Deductions and GST Benefits

- Businesses can claim interest and depreciation deductions on the asset, which may reduce taxable income. If the business is registered for GST, it can also claim the GST on the purchase price, a benefit not available with standard loans or operating leases.

3. Flexible Loan Terms

- Chattel mortgages offer flexible terms (typically 2-5 years) with options for balloon payments at the end, reducing monthly repayments. This flexibility is valuable for managing cash flow and budgeting for businesses with specific needs.

4. Lower Interest Rates Compared to Unsecured Loans

- Because the asset serves as collateral, lenders generally offer lower interest rates on chattel mortgages than on unsecured loans, making it a cost-effective option for asset financing.

Disadvantages of Chattel Mortgages

1. Asset Depreciation

- Since the borrower owns the asset, they also assume the risk of depreciation, which can be a disadvantage if the asset’s value drops significantly, such as with vehicles.

2. Reduced Flexibility in Asset Upgrades

- If a business expects to upgrade its equipment frequently, a chattel mortgage may be restrictive. In contrast, operating leases allow businesses to upgrade to new assets without the burden of ownership or resale.

3. Potential for Balloon Payments

- While balloon payments reduce monthly costs, they require a large final payment, which can strain finances if not adequately planned.

4. Commitment to Ownership and Maintenance

- Unlike leasing, where the asset is typically returned at the end, a chattel mortgage means the business is responsible for maintaining, insuring, and eventually disposing of the asset if it’s no longer needed.

5. Deciding Between a Chattel Mortgage and Alternatives

When deciding on financing options, a business should consider factors like the anticipated duration of asset use, tax position, cash flow needs, and the potential for asset depreciation. Below are some considerations:

- Best for Long-Term Ownership: Chattel mortgages are best for businesses that intend to keep the asset for the long term, as they offer ownership benefits from the outset and allow tax deductions on depreciation and interest.

- Best for Short-Term or High-Depreciation Assets: Operating leases are more suitable for businesses needing flexibility, especially for assets that may quickly become outdated. Leases provide an opportunity to upgrade or return the asset without ownership concerns.

- For Tax and Cash Flow Benefits: Finance leases or chattel mortgages may be ideal as they provide tax advantages, though chattel mortgages tend to offer more significant GST benefits upfront for GST-registered businesses.

- Low Maintenance Needs: Hire purchase is preferable if a business wants ownership after making all payments, but without maintenance responsibilities during the repayment term.

6. Conclusion

Chattel mortgages offer an attractive financing option for Australian businesses needing immediate ownership of essential assets while benefiting from tax deductions and potentially lower interest rates. However, they may not be the best choice for every business. By comparing chattel mortgages with finance leases, hire purchases, and other lending alternatives, businesses can select the option that aligns best with their operational goals, financial strategies, and asset usage plans. Ultimately, each financing option has unique features suited to different needs, and understanding these can help businesses optimize their approach to asset acquisition and cash flow management.

The team at Broker.com.au have vast experience of helping clients choose the right type of loan or lease, as each situation is unique. Reach out to us and we can help you tailor the best solution to your situation:

(email icon) [email protected]

(phone icon) 1300 373 300

To learn more about chattel mortgages and other financial solutions, visit our Resources & Learning page for helpful insights and resources.