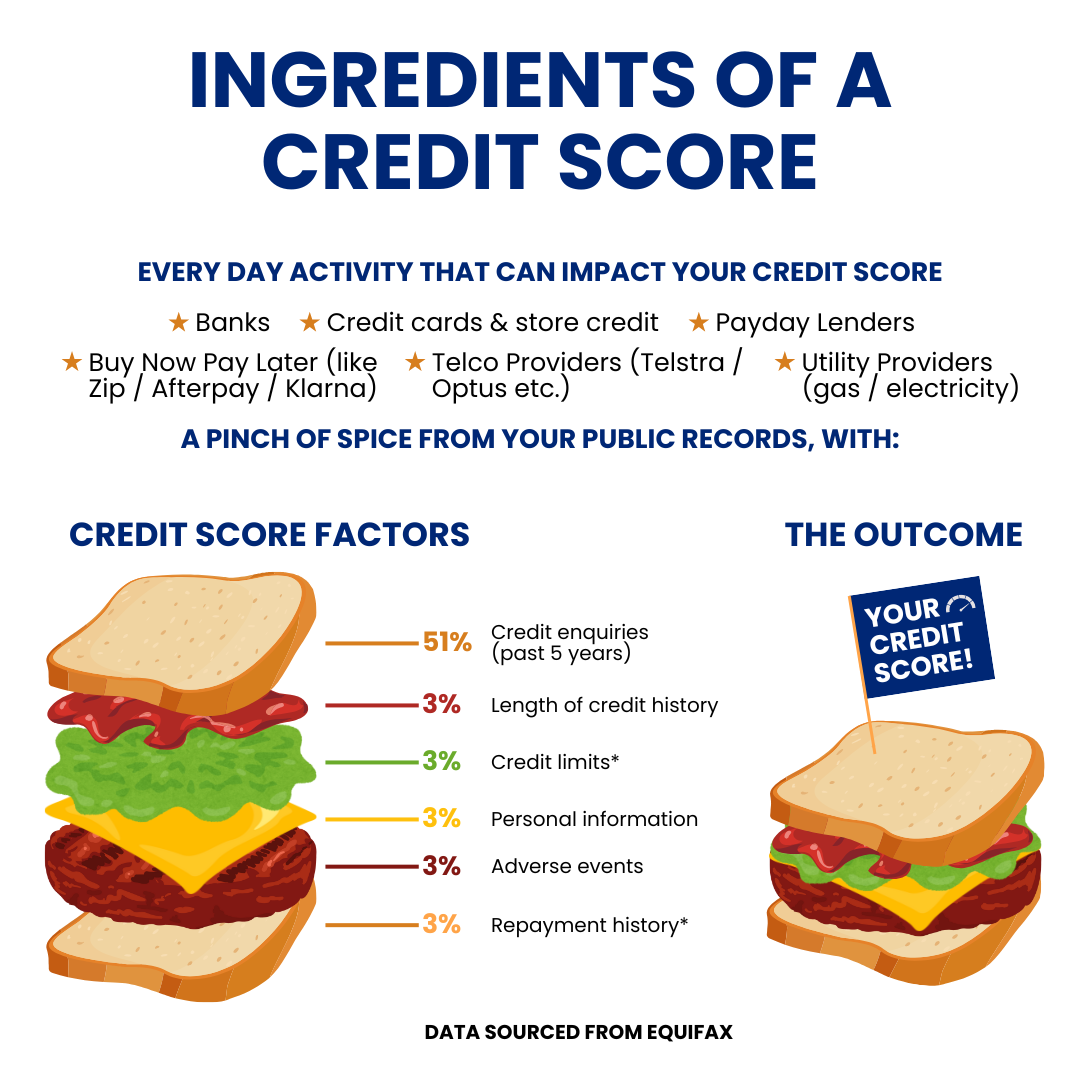

Here’s a detailed guide on the elements that influence your credit report:

1. Credit Card Usage

Having too many credit cards or high credit limits can negatively impact your credit score. Lenders view high credit limits as potential liabilities, even if you don’t use the full limit. Reducing unnecessary credit card limits can improve your score. Furthermore, consistently paying off your credit cards in full each month is beneficial.

2. Loan Inquiries and Applications

When you apply for credit, lenders perform a hard inquiry on your credit report. Too many hard inquiries in a short period signal financial distress, which lowers your score. Even if you don’t receive the loan, the inquiry remains on your report for up to two years. For example, if someone applies for several loans but is rejected each time, their credit score will drop, as multiple inquiries suggest they are struggling to access credit. It’s crucial to limit loan applications and only apply when you have a high chance of approval.

3. Personal Loans and Other Debt

Having various loans such as personal loans, mortgages, or car loans is common, but your debt-to-income ratio plays a key role in your creditworthiness. If lenders see that your debt is too high compared to your income, it can lower your chances of borrowing more. Managing and repaying loans consistently helps keep your score stable.

4. Utility and Phone Bill Payments

Missed or late payments on phone bills, utilities, and rent can also affect your credit report. Any bill that is overdue by more than 60 days and over $150 may be reported to credit agencies, impacting your credit score. Even something as simple as not updating your address after moving could result in bills being sent to the wrong address, which can negatively affect your score if not paid.

5. Types of Credit

Using a mix of credit types—such as a home loan, credit card, and personal loan—can work in your favor, showing lenders that you can manage various forms of credit responsibly. However, this only has a small positive effect compared to the weight of factors like repayment history and the number of credit inquiries.

6. Repayment History

Your repayment history is one of the most critical factors. Late or missed payments can stay on your credit report for up to five years, while defaults remain for seven years. The more recent the missed payment, the greater the impact on your credit score.

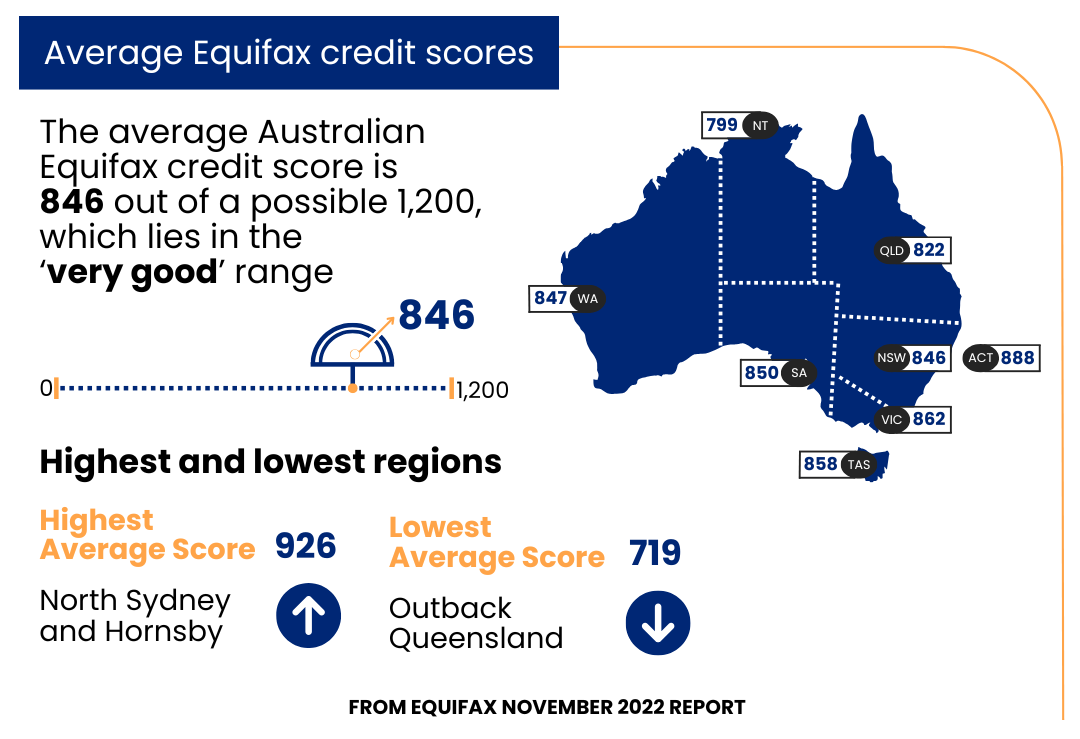

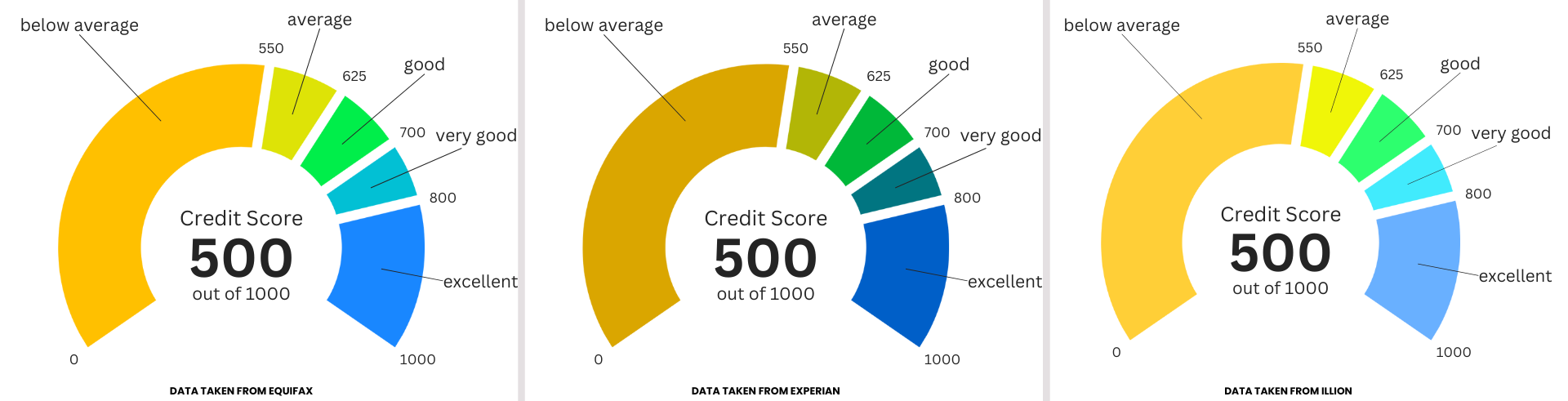

7. Credit Score Ranges

Credit score bands vary by the credit reporting agency (Equifax, Experian, and Illion), but typically, the ranges are as follows:

Equifax:

- Below Average: 0-459

- Average: 460-660

- Good: 661-734

- Very Good: 735-852

- Excellent: 853-1,200

Experian:

- Below Average: 0-549

- Fair: 550-624

- Good: 625-699

- Very Good: 700-799

- Excellent: 800-1,000

Illion:

- Zero Score: 0

- Room to Improve: 300-499

- Good: 500-699

- Excellent: 800-1,000

Australia’s 3 main credit reporting agencies:

Example of Impact

Let’s say someone applies for multiple loans in a short period but doesn’t get approved. Each application triggers a hard inquiry, which lowers their score. Even though they haven’t taken on more debt, the sheer number of inquiries can significantly impact their credit score. Additionally, if they’re rejected because of a high debt-to-income ratio, their chances of future approvals diminish until their financial situation stabilises.

Managing Your Credit Report

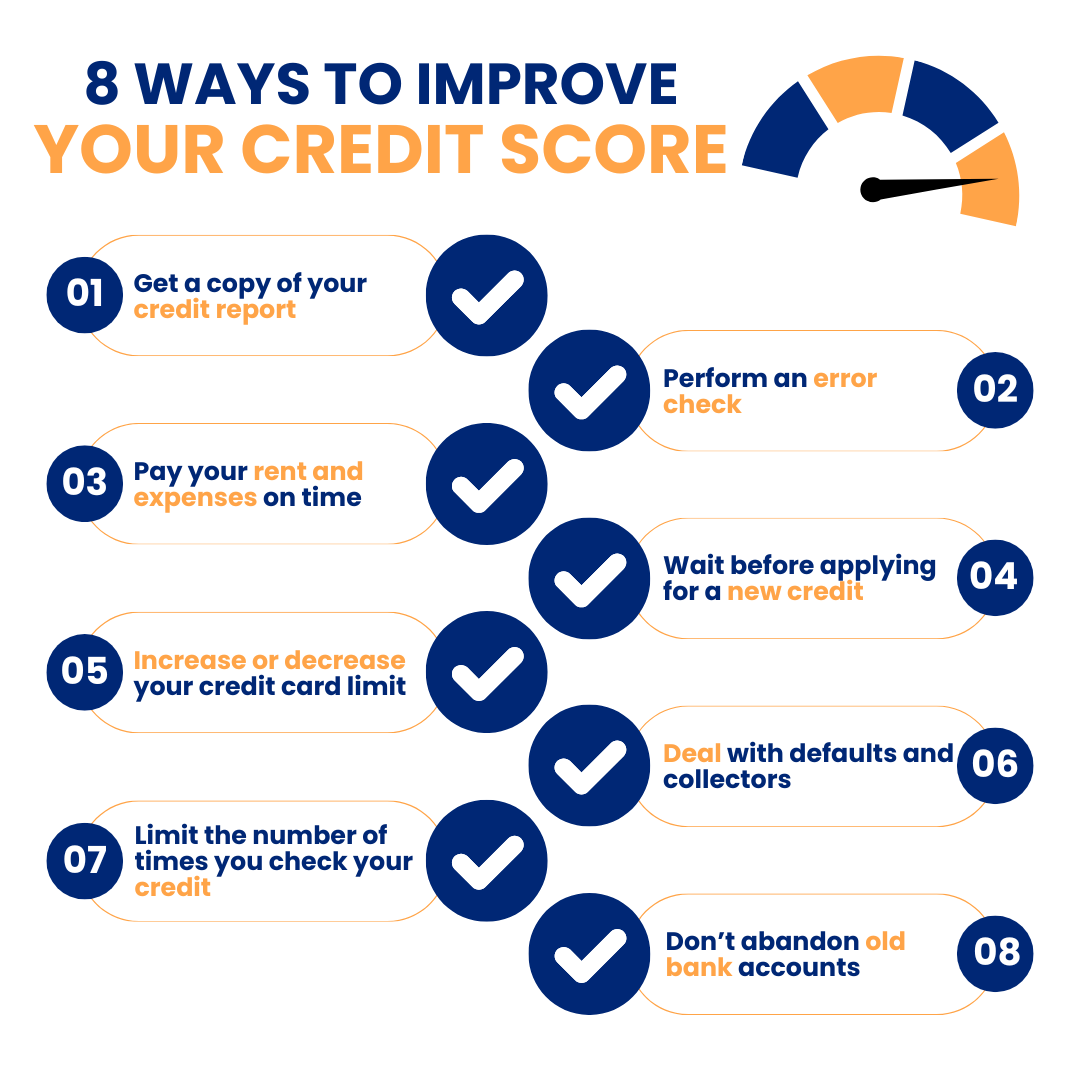

To maintain a good credit score:

- Avoid excessive credit applications.

- Keep credit card limits reasonable.

- Ensure all bills are paid on time, and notify utility companies if you change addresses.

- Use a mix of credit products and keep older accounts open to show a stable credit history.

- Check your credit report regularly to ensure no incorrect information is listed.

In summary, managing your credit usage, limiting inquiries, and maintaining a good repayment history are crucial for a healthy credit score. Avoid missing payments on utilities and other bills, as even minor oversights can have a lasting effect on your credit file.

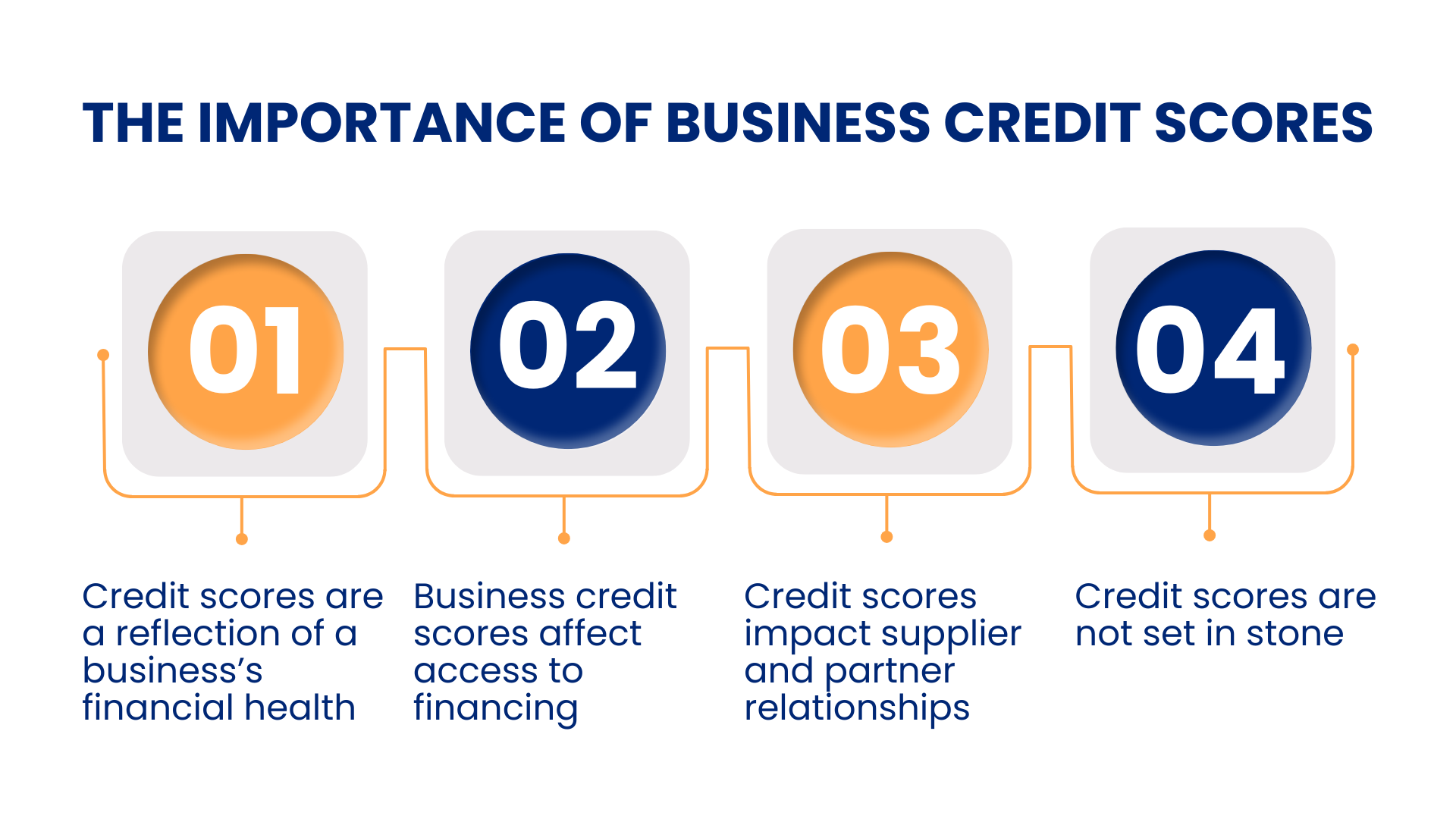

What Business Owners Need To Think About When It Comes To Credit Scores

For business owners in Australia, their personal credit score plays a critical role in their business’s ability to access financing. While a strong business plan, cash flow, and business credit history are essential, lenders often evaluate the owner’s personal credit history, especially for small businesses and sole proprietors. In this guide, we’ll explore the impact of personal credit scores on business borrowing, what lenders look for, and how poor personal credit can prevent a business from securing loans.

1. Why Lenders Consider Personal Credit Scores

Lenders often view the financial habits of business owners as indicative of how they will manage business finances. This is especially true for smaller businesses where the line between personal and business finances can blur. For sole proprietors or those running smaller entities without a strong business credit history, the personal credit score is a primary determinant of risk.

Banks and lenders want assurance that the individual behind the business is financially responsible, and your personal credit score provides them with a snapshot of your financial behaviour. A poor credit score might indicate that you’ve struggled with managing debt, making timely payments, or overextending credit lines—all of which raise red flags for potential business lenders.

2. How Personal Credit Affects Business Loan Applications

Personal credit scores influence a lender’s decision on:

- Approval: If your credit score is low, lenders may decline your loan application outright, particularly if the business is in its early stages and doesn’t yet have a solid credit history.

- Loan Amount: With a poor personal credit score, lenders may approve smaller loan amounts than what you’re requesting, limiting your ability to expand the business as planned.

- Interest Rates: High-risk borrowers—those with low credit scores—are typically offered loans with higher interest rates. This can lead to larger repayment amounts, straining the business’s cash flow.

- Collateral Requirements: Business owners with low credit scores might be asked to provide additional collateral, such as personal property or business assets, to secure the loan.

For example, a business owner with a personal credit score of 500 might find it difficult to access a large loan, even if their business is profitable. The lender might approve a smaller loan with higher interest rates or require the owner to provide a personal guarantee, putting their own assets at risk.

3. Factors Lenders Evaluate for Business Loans

When applying for a business loan, lenders typically assess several factors:

- Personal Credit Score: For small and medium-sized businesses (SMBs) and startups, the owner’s credit score is one of the main factors influencing the lender’s decision.

- Business Credit Score: If the business has been operating for some time, its credit score will also be reviewed. This reflects the business’s ability to repay debts, including loans, supplier credits, and leases.

- Business Financials: Lenders look at the business’s financial performance, including cash flow, profitability, and outstanding debts. If the business shows healthy financials, this can sometimes offset a lower personal credit score.

- Debt-to-Income Ratio: Lenders want to ensure the business isn’t over-leveraged. A high debt-to-income ratio in either the business or the owner’s personal finances can negatively affect loan eligibility.

- Industry Risk: Certain industries are riskier than others. If your business operates in a volatile or high-risk sector (e.g., hospitality, retail), lenders may be more cautious about lending, especially if your personal credit score is low.

- Time in Business: Startups and newer businesses are considered riskier by lenders. If you’re running a newer business, your personal credit score becomes even more critical.

4. The Impact of a Bad Personal Credit Score

A low personal credit score can have several consequences for your business, particularly when seeking funding. Let’s examine how this might play out in an example.

Example:

Business Owner with a Bad Credit Score

Sarah runs a small online retail business. She has been operating for 18 months and needs a $50,000 loan to expand her inventory ahead of the holiday season. However, Sarah’s personal credit score is 520 due to past missed payments on a personal loan and credit card debt. She applies for a loan through a traditional bank, but her application is rejected due to her poor credit history, despite the business generating consistent revenue.

Sarah decides to apply for a loan from a second lender, a non-bank lender that specialises in small business loans. This lender approves her loan, but at a higher interest rate than she expected—13% instead of the market average of 8%. Sarah also has to provide a personal guarantee, meaning her home is at risk if she defaults on the loan.

In this case, Sarah’s bad credit score:

- Limited Her Options: Fewer lenders were willing to offer her the loan.

- Increased Her Costs: She secured financing but at a higher cost due to the increased interest rate.

- Increased Risk: The personal guarantee added a layer of risk that Sarah wouldn’t have faced with better credit.

5. Improving Personal Credit for Business Success

If you are a business owner and have a low personal credit score, improving it can help you access better financing options in the future. Here’s how to work on your credit score:

- Make Payments on Time: Late payments, whether on personal loans, mortgages, or credit cards, heavily impact your credit score. Set up automatic payments where possible to avoid missing due dates .

- Reduce Credit Card Balances: High credit card balances, even if you make minimum payments, can harm your score. Aim to keep your credit utilisation below 30% of your available credit limit.

- Limit New Credit Applications: Each time you apply for credit, it results in a hard inquiry on your report. Limit unnecessary applications to prevent this from lowering your score.

- Check Your Credit Report: Regularly check your credit report to ensure it’s accurate. Mistakes or fraudulent activities can drag your score down unnecessarily .

6. Building Business Credit

In addition to improving your personal credit, focus on building your business credit score:

- Open Business Credit Accounts: This could include a business credit card or a small business loan. Ensure all payments are made on time.

- Register with Credit Bureaus: Ensure your business credit activity is reported to the appropriate credit reporting agencies like Equifax and Illion.

- Separate Business and Personal Finances: Keeping your personal and business finances separate will help you build a distinct business credit history.

7. Conclusion

As a business owner, your personal credit score can have a substantial impact on your ability to secure financing. Poor personal credit may limit your borrowing options, increase costs, or lead to additional collateral requirements. To protect your business’s financial health and growth potential, it’s essential to maintain a good personal credit score while also working to build a strong business credit profile.

To learn more about credit scores and other financial factors, visit our Resources & Learning page for helpful insights and resources.

Broker.com.au can assist you in understanding how your credit score impacts loan applications. Reach out to us today!