A GSA gives the lender rights to claim your business assets as collateral if you default on your loan. This agreement is typically registered on the Personal Property Securities Register (PPSR). In this guide, we’ll explain what a GSA is, how it works with the PPSR, and the steps to remove an old PPSR registration that’s no longer needed. We’ll also explore how unresolved PPSR registrations can impact future loan applications and how to resolve these issues.

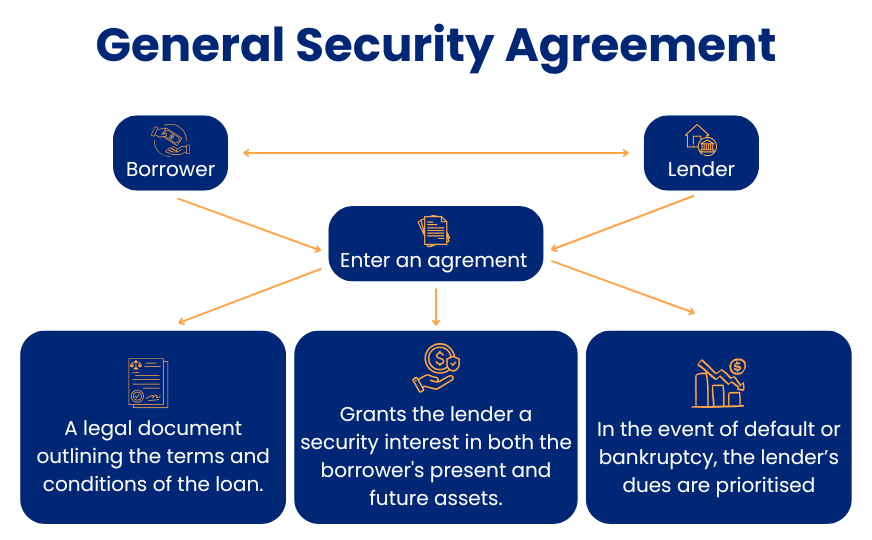

What is a General Security Agreement (GSA)?

A General Security Agreement is a legal document used by lenders to secure a loan against a borrower’s business assets. It allows the lender to claim these assets if the borrower fails to meet their repayment obligations. The GSA is a common feature of small business lending in Australia, especially when the loan involves unsecured funding or higher risk to the lender.

Key Features of a GSA:

1. Comprehensive Coverage: A GSA covers all present and future assets of the business, unless specifically excluded. This may include:

- Inventory

- Equipment

- Accounts receivable

- Intellectual property

2. Secured Debt: It ensures the lender has priority over the secured assets in case of liquidation or insolvency.

3. Enforceable Rights: If the borrower defaults, the lender can enforce the GSA by seizing or selling the secured assets to recover the loan amount.

What is the Personal Property Securities Register (PPSR)?

The Personal Property Securities Register (PPSR) is an online registry managed by the Australian Financial Security Authority (AFSA). It allows individuals and businesses to register, search, and manage security interests in personal property.

Key Functions of the PPSR:

- Registering Security Interests: Lenders use the PPSR to officially record a GSA, securing their claim over a business’s assets.

- Transparency: It provides public access to information about existing security interests, helping other lenders or potential buyers identify encumbrances on assets.

- Legal Protections: A properly registered security interest on the PPSR gives the lender priority over unregistered or subsequent claims on the same assets.

How is a GSA Registered on the PPSR?

When a lender issues a business loan and requires a GSA, the registration process involves:

1. Execution of the GSA: The borrower and lender sign the General Security Agreement, detailing the terms and the scope of secured assets.

2. PPSR Registration:

- The lender (or their legal representative) creates a registration on the PPSR.

- Key details include the borrower’s business information, the secured party’s details, and a description of the collateral covered by the GSA.

3. Verification Statement: After registration, the PPSR issues a verification statement to confirm the security interest.

Why is the PPSR Important?

The PPSR protects lenders by providing a legal framework for securing their interests. For borrowers, it’s essential to understand its implications:

For Lenders:

- Ensures their claim over assets is legally recognized and enforceable.

- Prioritizes their interests over unregistered creditors or later claims.

For Borrowers:

- Offers clarity on the terms of secured obligations.

- Helps manage and track active security interests, ensuring no unexpected claims arise.

Removing a PPSR Security Registration

Once the debt secured by a GSA is repaid in full, the GSA and its associated PPSR registration should be removed.

Steps to Remove a PPSR Registration:

1. Loan Repayment Confirmation: Ensure the loan is fully repaid and obtain a written confirmation from the lender.

2. Request Removal:

- Contact the lender and request they discharge the security interest on the PPSR.

- Lenders are obligated to act promptly once the debt is settled.

3. Verification:

- Check the PPSR to ensure the registration has been discharged.

- Obtain a copy of the updated PPSR record for your files.

Why Remove an Old GSA?

- An unresolved GSA on the PPSR signals to other lenders that your business still has existing obligations, even if the loan is repaid.

- It can limit your borrowing capacity, as new lenders may hesitate to issue additional loans without clarity on existing security interests.

How to Handle an ‘Old’ GSA That Was Not Removed

Impact on New Loan Applications:

An old GSA still registered on the PPSR may cause:

- Reduced Borrowing Capacity: New lenders may view your business as over-leveraged.

- Delays in Loan Approval: Lenders may require clarification or proof that the prior loan has been repaid.

- Rejection of Applications: Some lenders may decline applications outright if unresolved registrations create uncertainty.

Steps to Remove an Outdated GSA:

1. Identify the Registration: Search the PPSR using your business’s details to locate the outdated GSA.

2. Contact the Secured Party:

- Reach out to the lender or secured party listed on the PPSR registration.

- Provide evidence that the debt has been repaid.

3. Request Discharge:

- Formally request the lender to remove the PPSR registration.

- If the lender is uncooperative, consider seeking legal advice or contacting the AFSA for guidance.

Why Might a GSA Be Removed?

A GSA is typically removed under the following circumstances:

- Loan Repayment: The debt secured by the GSA has been fully repaid.

- Loan Refinancing: The borrower has refinanced the loan with another lender, and the new lender requires a fresh GSA.

- Business Sale: The business is sold, and the new owner does not wish to retain the previous GSA arrangements.

Tax Implications of GSAs and PPSR Registrations

When Your Home Property is Used as Security:

Many business loans are secured using personal property, such as the borrower’s home. This arrangement can have tax implications:

1. Deductibility of Interest:

- Interest on a business loan secured by a home may be tax-deductible if the funds are used solely for business purposes.

- Always maintain clear records to separate personal and business loan usage.

2. Refinancing Considerations:

- Shifting debt from a home loan to a business loan may improve tax efficiency, as business loan interest is generally tax-deductible.

Seek Professional Advice:

- Consult with a tax advisor or accountant to structure loans in the most tax-effective manner.

- Understand the implications of using personal assets for business security.

Best Practices for Managing GSAs and PPSR Registrations

- Understand the Agreement: Fully review the terms of the GSA and its implications for your business assets.

- Monitor PPSR Registrations: Regularly check the PPSR for active registrations against your business to avoid surprises.

- Prompt Removal of Old GSAs: Ensure outdated PPSR registrations are discharged immediately after debts are repaid.

- Clear Communication: Clearly explain the terms of the GSA and its implications to borrowers.

- Timely Discharges: Act promptly to remove PPSR registrations once the debt is settled.

Conclusion and Disclaimer

Disclaimer: