While both options aim to reduce the amount of interest you pay, they operate differently and offer distinct advantages. Here’s a comprehensive comparison to help you understand their differences and determine which might be best for your financial situation.

Offset Account

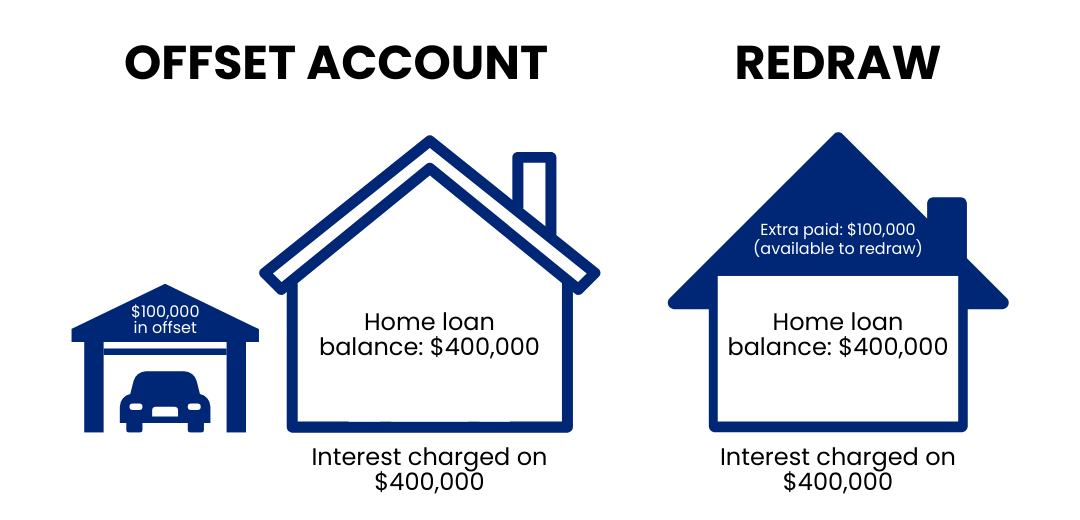

1. What is an Offset Account? An offset account is a transaction account linked directly to your mortgage. The balance in this account is offset daily against your loan principal, reducing the amount of interest you pay on your mortgage.

2. How It Works:

- Interest Calculation: The interest on your mortgage is calculated on the difference between your loan principal and the offset account balance.

Example: If you have a mortgage of $300,000 and $50,000 in your offset account, interest is calculated on $250,000.

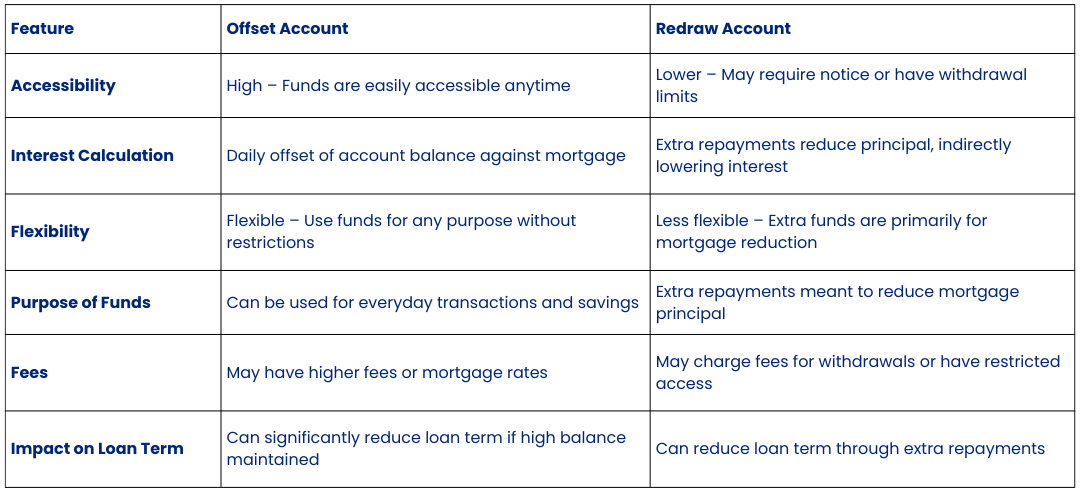

3. Accessibility:

- High Liquidity: Funds in an offset account are easily accessible. You can deposit and withdraw money as you would with any regular bank account.

4. Types of Offset Accounts:

- Full Offset: 100% of the account balance offsets the mortgage principal.

- Partial Offset: Only a portion of the account balance offsets the mortgage principal.

5. Benefits:

- Interest Savings: Directly reduces the amount of interest payable on your mortgage.

- Flexibility: Easy access to your funds for everyday expenses, emergencies, or other financial needs.

- Potential to Pay Off Mortgage Faster: By reducing the interest, more of your regular repayments go towards the principal.

6. Considerations:

- Fees and Costs: Offset accounts may come with higher fees or require a higher interest rate on the mortgage.

- Discipline Required: To maximise benefits, maintaining a high balance in the offset account is essential.

Redraw Account

1. What is a Redraw Account? A redraw account allows you to make extra repayments on your mortgage and then withdraw those extra funds if needed in the future.

2. How It Works:

- Extra Payments: When you make additional repayments beyond your regular mortgage payments, these extra funds go into your redraw account.

- Accessing Funds: You can withdraw these extra payments if required, though the process may not be as immediate as with an offset account.

3. Accessibility:

- Limited Access: Withdrawals from a redraw account may require notice and can be subject to restrictions or fees, depending on your lender’s policies.

4. Types of Redraw Facilities:

- Restricted Redraw: Limits the number or amount of withdrawals you can make.

- Unlimited Redraw: Allows you to withdraw any extra payments without restrictions, subject to lender terms.

5. Benefits:

- Interest Savings: Extra repayments reduce the principal, thereby reducing the total interest payable over the life of the loan.

- Potential to Pay Off Mortgage Faster: Similar to an offset account, by reducing the principal, you can shorten the loan term.

- Encourages Saving: Committing to extra repayments can help you build equity in your home more quickly.

6. Considerations:

- Access Restrictions: May not be as easily accessible as an offset account, with possible fees or required notice periods for withdrawals.

- Potential Fees: Some redraw facilities may charge fees for accessing funds.

- Less Flexibility: If you need quick access to funds, a redraw account might not be as convenient as an offset account.

Key Differences Between Offset and Redraw Accounts

Which Option is Right for You?

Choose an Offset Account if:

- You want easy access to your savings for everyday use or emergencies.

- You maintain a high balance in the account regularly.

- Flexibility in managing your funds is important to you.

Choose a Redraw Account if:

- You can commit to making regular extra repayments without needing immediate access to those funds.

- You prefer using extra funds strictly for reducing your mortgage principal.

- You don’t need the flexibility to access your extra payments frequently.

Combination of Both:

Some lenders offer the option to have both an offset and a redraw account linked to your mortgage. This setup provides the benefits of both features, allowing you to reduce your interest payments while still having access to extra funds if needed.

What is best for me?

Both offset and redraw accounts offer valuable ways to manage your mortgage more effectively and reduce the amount of interest you pay over time. The best choice depends on your financial habits, your need for access to funds, and your ability to make extra repayments consistently. Consulting with a mortgage broker or financial advisor can help you determine which option aligns best with your financial goals and lifestyle.

Tip: Regularly reviewing your mortgage features and financial strategy can help you maximise savings and ensure that your mortgage is working effectively for you.

To explore more resources and expand your knowledge about mortgage options, including offset and redraw, visit our comprehensive Resources & Learning page.

Broker.com.au can help you find the best mortgage option. Reach out to us today!