The Popularity of SMSFs in Australia

As of 2024, there are over 600,000 registered SMSFs in Australia, managing close to $900 billion in assets. Many SMSF trustees choose to invest in property. According to the Australian Taxation Office (ATO), about 17% of all SMSF assets are in direct property investments.

Let’s break this down into specific types of property investments within SMSFs:

- Residential property: 33.1%

- Commercial property: 63.9%

- Industrial property: 1.75%

- Other property types (rural, etc.): 1.25%

Property Types within SMSFs

- Residential Property: SMSFs can purchase residential property, but there are strict regulations about how it can be used. The property must be an investment and cannot be lived in or rented by a member of the fund or their relatives.

- Commercial Property: This is a popular choice for SMSFs. It’s possible to lease the property back to your own business. This makes commercial property particularly appealing for business owners who want to keep their business premises “in-house” within their SMSF. It also allows for some strategic tax planning.

- Industrial Property: While less common, industrial properties are sometimes included in SMSF portfolios, though their complexities and market volatility make them less attractive for most investors.

- Other Property Classes: This can include rural and specialized types of property. These are a very small portion of SMSF investments.

Financing SMSF Property with Loans

Purchasing property within an SMSF is possible through a limited recourse borrowing arrangement (LRBA). This means that the loan is secured against the asset being purchased, and in the event of a default, the lender’s recourse is limited to the asset in question.

However, investing in property through an SMSF comes with some restrictions:

- The property can not be purchased from or used by a related party, except in the case of commercial property used by your own business.

- The property must meet the “sole purpose test,” meaning it should solely provide retirement benefits to fund members.

- If an SMSF property is negatively geared, tax deductions can be claimed on the losses, but these are restricted to the SMSF’s income.

Limited Recourse Borrowing For SMSF

Although Self-Managed Super Funds (SMSFs) are generally prohibited from borrowing, an exception to this rule is through a Limited Recourse Borrowing Arrangement (LRBA).

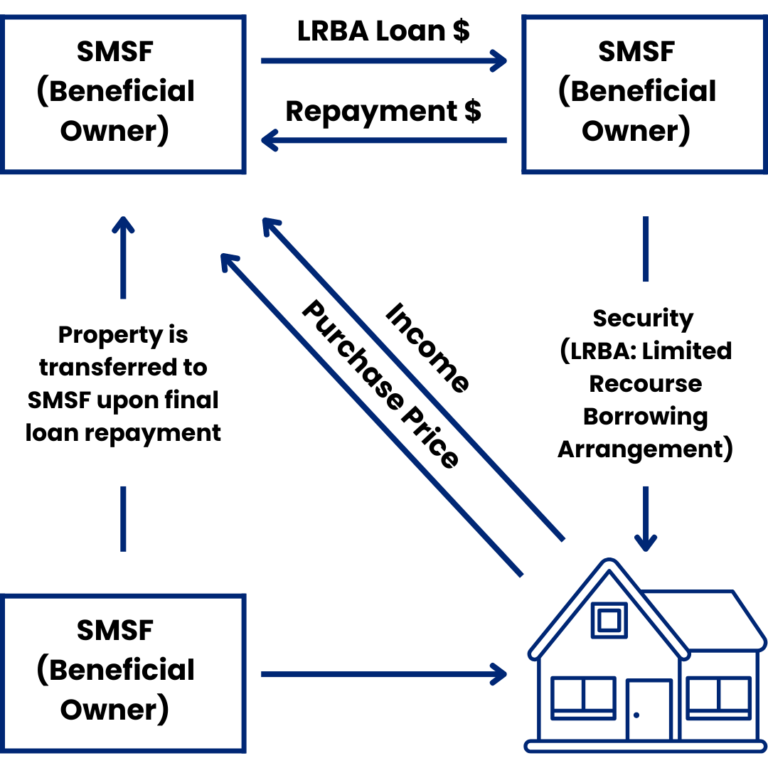

Here’s a simplified explanation of how it works:

- Your SMSF wants to purchase property but doesn’t have enough funds to cover the full cost, so it seeks a loan from a lender.

- The lender or the SMSF establishes a Holding Trust, which becomes the legal owner of the property.

- The lender sets up an LRBA loan for the SMSF.

- The SMSF contributes toward the property’s purchase price.

- Income generated from the property goes directly to the SMSF.

- The SMSF makes loan repayments to the lender.

- Once the loan is fully repaid, ownership of the property transfers to the SMSF.

The arrangement gets its name because if the SMSF defaults on the loan, the lender’s recourse is limited to the asset held in the separate Holding Trust (also known as a Security Trust, Bare Trust, or Security Custodian Trust). The lender cannot pursue other assets within the SMSF, ensuring the rest of the fund’s assets remain protected.

This is a straightforward overview of how borrowing through an SMSF typically works.

Challenges of SMSF Loans

Lenders offering SMSF loans often have stricter conditions than those for regular property loans. This may include:

- Higher interest rates

- Larger deposits (often 30%-40%)

- Limited loan-to-value ratios (LVRs)

Some lenders may also require the SMSF to have a certain amount of liquidity after the property purchase to ensure ongoing compliance and the ability to cover loan repayments and other expenses.

Conclusion

Property investment through an SMSF can be a great way to diversify your retirement portfolio, but it is not without challenges. Understanding the types of properties you can invest in and the restrictions that come with them is essential. Moreover, SMSF loans often have unique conditions that make them different from traditional loans. For business owners, the ability to lease a commercial property investment back to your business is a distinct advantage, providing both flexibility and potential tax savings.

Before diving into SMSF property investments, it’s wise to consult with financial and legal professionals to ensure compliance and optimize the benefits of SMSF loans.

For more information and guidance on lending within SMSF’s, reach out to the team at Broker.com.au. PH: 1300 373 300 or [email protected]