However, the process of securing financing for such investments differs significantly from traditional individual lending. This article explores the nuances of lending to a trust for property investment, examining how banks and non-bank lenders assess these applications, the implications of gearing strategies, necessary income verifications, and the regulatory landscape governing such transactions.

Understanding Trust Structures in Property Investment

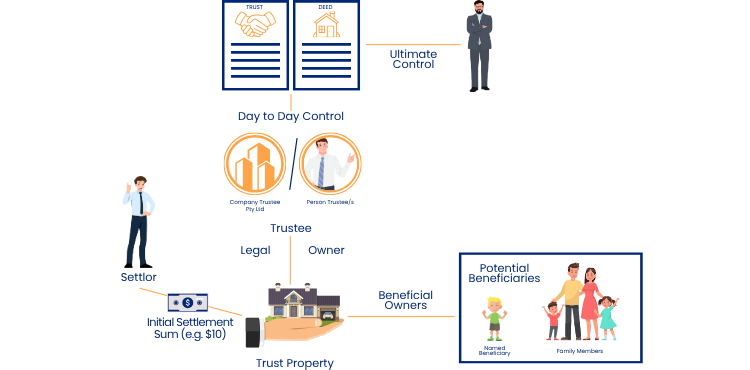

A trust is a legal arrangement where a trustee holds and manages assets on behalf of beneficiaries. In property investment, trusts are often utilized to manage and protect assets, distribute income, and potentially optimize tax obligations. Common types of trusts in Australia include:

- Family Trusts (Discretionary Trusts): These allow trustees to distribute income and capital to beneficiaries at their discretion, offering flexibility in income distribution.

- Unit Trusts: In this structure, beneficiaries (unit holders) have fixed entitlements, with income and capital distributed according to the number of units held.

- Hybrid Trusts: These combine features of both discretionary and unit trusts, providing a blend of flexibility and fixed entitlements.

Lender Perspectives: Trusts vs. Individual Borrowers

Lending to a trust differs from lending to an individual due to the complexities involved in trust structures. Lenders must assess not only the financial standing of the trust but also the legal framework governing it. Key considerations include:

- Complexity and Documentation: Trust loans require meticulous examination of trust deeds to understand the powers and limitations of trustees, as well as the rights of beneficiaries. This additional scrutiny often leads to increased processing times and administrative efforts.

- Risk Assessment: Lenders perceive higher risks in trust lending due to potential complexities in legal recourse and the enforceability of loan agreements. Consequently, some lenders may impose stricter lending criteria or offer less favorable terms for trust loans.

- Limited Lender Pool: Not all financial institutions offer loans to trusts. Those that do may channel such applications through their business or commercial lending divisions, which often have more stringent requirements compared to personal lending.

Gearing Strategies: Positive vs. Negative Gearing

Gearing refers to borrowing to invest, with the investment’s income relative to its expenses determining whether it is positively or negatively geared:

- Positive Gearing: Occurs when the investment’s income exceeds its expenses, resulting in a profit. In a trust structure, this profit can be distributed to beneficiaries, potentially taxed at their marginal tax rates.

- Negative Gearing: Occurs when the investment’s expenses surpass its income, leading to a loss. Individually, such losses can offset other taxable income, reducing overall tax liability. However, in a trust, these losses are typically retained within the trust and cannot be distributed to beneficiaries to offset their personal income.

It’s important to note that some lenders may require the trust’s investment to be positively geared to ensure the trust’s ability to service the loan without relying on external income sources.

Income Verification and Serviceability Assessments

Lenders assess a borrower’s capacity to repay the loan through serviceability assessments, which evaluate income, expenses, and existing debts. In the context of trust lending:

- Trust Income: Lenders examine the trust’s income, including rental income from investment properties and any other earnings. They may require financial statements and tax returns to verify this income.

- Beneficiary Income: While the trust is the borrowing entity, lenders often consider the financial standing of beneficiaries, especially if they provide personal guarantees. Beneficiaries may need to furnish proof of income, assets, and liabilities.

- Asset-Based Lending: In certain cases, lenders may focus primarily on the value of the property being purchased (asset-based lending). However, this approach is less common, and most lenders prefer comprehensive income verification to ensure loan serviceability.

Restrictions and Considerations in Trust Lending

Investing in property through a trust entails specific restrictions and considerations:

- Tax Implications: Trusts do not benefit from negative gearing in the same way individuals do, as losses are typically trapped within the trust. Additionally, trusts may be subject to different land tax thresholds and rates, depending on the jurisdiction.

- Asset Protection: While trusts can offer asset protection benefits, they must be properly structured and managed to ensure these protections are effective.

- Setup and Maintenance Costs: Establishing a trust involves legal and administrative expenses, and ongoing compliance requirements can add to the cost. Prospective investors should weigh these costs against the potential benefits.

- Lender Policies: Each lender has its own policies regarding trust lending, including acceptable trust structures, required documentation, and lending criteria. Engaging with a mortgage broker experienced in trust lending can help navigate these varying requirements.

Regulatory Framework Governing Trust Lending

Trust lending in Australia is subject to a comprehensive regulatory framework designed to ensure financial stability and consumer protection:

- Australian Prudential Regulation Authority (APRA): APRA oversees financial institutions, setting prudential standards to promote sound risk management practices. While APRA does not directly regulate trust structures, its guidelines influence lenders’ policies on trust lending.

- Australian Securities and Investments Commission (ASIC): ASIC regulates financial services and markets, ensuring transparency and fairness. Trustees must comply with ASIC’s requirements, particularly if the trust engages in investment activities.

- Australian Taxation Office (ATO): The ATO administers tax laws related to trusts, including income distribution, capital gains, and compliance obligations. Trustees are responsible for ensuring the trust meets all tax reporting and payment requirements.

Acquiring a loan via a Trust for the purpose of building wealth through property can be a rewarding strategy and structure. But as this brings about more complexities, it is worth speaking with an experienced Broker who can navigate the path and help you secure the right structure for your goals. Reach out to our team who are well equipped to guide you through this process: email us at [email protected] or phone 1300 373 300.

To explore more resources and expand your knowledge about property investment, business loans, and other financial solutions, visit our comprehensive Resources & Learning page.