Non-bank lenders have increasingly gained market share, often outperforming the traditional “Big Four” banks (ANZ, NAB, CBA, and Westpac) due to their flexible loan products, competitive rates, and faster approval times.

A finance broker who has access to both banks and non-bank lenders can help show you options for you to work out who is best for you and your business.

Let’s take a look at the Australian landscape!

The Shift Towards Non-Bank Lenders

Non-bank lenders have seized market share by offering more personalised, faster, and less bureaucratic services compared to banks. According to data from the Australian Prudential Regulation Authority (APRA) and Australian Bureau of Statistics (ABS), non-bank lenders now account for about 20-25% of total SME lending, a significant rise from less than 10% five years ago. This growth is fuelled by several factors:

- Flexibility and Speed: Non-bank lenders are less constrained by regulatory requirements, enabling faster approval processes. SMEs, especially those seeking urgent capital, benefit from this efficiency.

- Alternative Risk Assessment: Non-banks often use more modern, data-driven methods for assessing borrower risk, allowing them to lend to businesses that traditional banks might reject.

- Niche and Tailored Products: Unlike banks, non-bank lenders offer specialised products for sectors such as technology startups, professional services, and construction.

Australian SMEs: The Backbone of the Economy

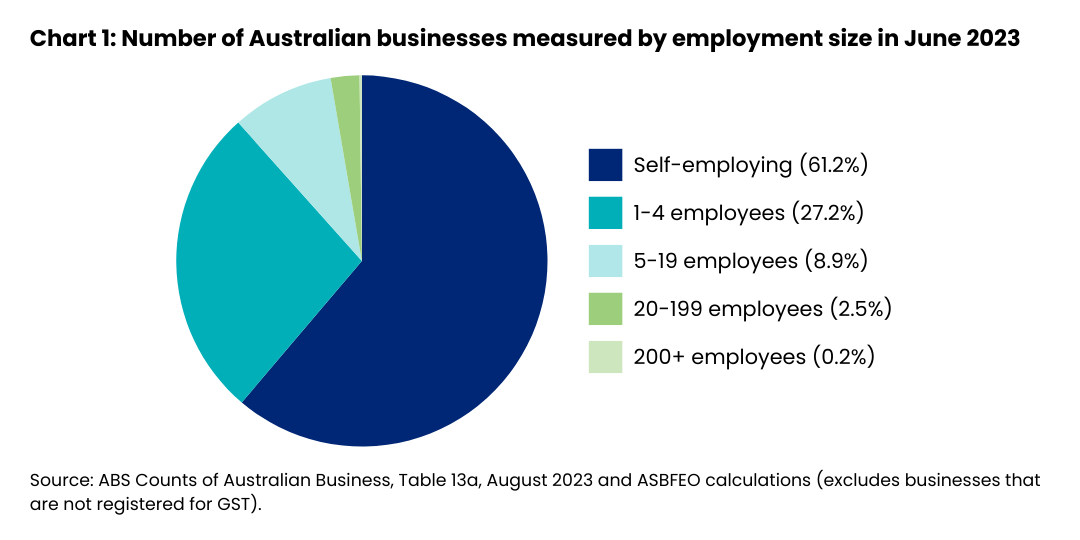

Small to medium-sized enterprises (SMEs) are the backbone of the Australian economy. With over 2.5 million registered businesses, a vast majority of them are classified as SMEs. Interestingly, a significant portion of these—around 88%—employ fewer than five people. These tightly run, lean operations form the core of local communities, providing essential services and contributing significantly to employment and GDP.

Operating with fewer than five employees means that these businesses are highly streamlined, often requiring owners to wear many hats. They maintain agility and adaptability, essential for surviving in a rapidly changing market. However, one of the key challenges for these small businesses is access to capital. With limited resources, many of these companies struggle to scale up, innovate, or invest in new opportunities that could boost their competitiveness.

This is where lending plays a crucial role. Access to financing allows these small enterprises to invest in technology, hire additional staff, and expand their operations. Whether it’s taking out loans for new equipment, purchasing a commercial property, or financing marketing initiatives, lending helps bridge the gap between aspiration and growth.

In recent years, the lending landscape for SMEs has become more favorable, with banks and alternative lenders offering flexible products tailored to small businesses. From unsecured business loans to equipment financing, the options are diverse and increasingly accessible.

In my opinion, by providing SMEs with affordable and flexible lending solutions, lenders give these businesses the opportunity to take calculated risks and explore growth possibilities that would otherwise be unattainable. With the right financing, small businesses can elevate their operations, fueling both their success and Australia’s broader economic growth. The future of Australian SMEs will be brighter with the continued support of lending solutions.

Statistics on SME Lending Volumes

According to APRA’s 2023 report, the total SME lending volume from non-bank lenders reached $60 billion in 2023, an increase from $40 billion in 2018. Over the past twelve months, non-bank SME lending saw an annual growth rate of approximately 12%, compared to just 3-5% growth in SME lending from traditional banks.

For context, total lending to SMEs in Australia (including both banks and non-banks) stood at approximately $400 billion in 2023, with banks still holding the majority share, but losing ground to more agile non-bank competitors.

Breakdown of Business Sectors Borrowing from Non-Banks

Non-bank lenders have targeted specific sectors where banks may have been more conservative, helping them grow their market share. The most significant shifts have occurred in:

- Construction and Real Estate Development: Nearly 30% of all loans in these sectors now come from non-banks. These industries require fast access to capital, and non-bank lenders offer quicker approval processes and more flexible terms.

- Technology Startups: Non-banks are more open to providing working capital and growth funding to tech companies, which often have unconventional financial metrics or limited operating history.

- Professional Services: Lawyers, accountants, and consultants are increasingly turning to non-bank lenders for expansion loans and cash flow support, as they often do not have the hard assets banks typically require as collateral.

- Retail and Hospitality: In sectors like retail and hospitality, where cash flow volatility is common, non-banks have introduced revenue-based financing and other tailored solutions.

Why SMEs Prefer Non-Banks

Several factors make non-bank lenders attractive to SMEs:

- Less Stringent Requirements: Traditional banks typically require extensive financial documentation, profitability records, and higher credit scores, which SMEs may struggle to provide.

- Asset Flexibility: Non-banks are often willing to accept non-traditional assets as collateral, such as receivables or future revenues.

- Quick Turnaround: Unlike the Big Four, non-banks can offer loan approvals in as little as 24-48 hours, compared to several weeks with banks.

Key Non-Bank Lenders in Australia

Some of the leading non-bank lenders in Australia’s SME sector include:

- Prospa: Known for its quick turnaround on small business loans, Prospa has become one of the top non-bank lenders, lending more than $2 billion to over 29,000 Australian businesses since its founding.

- Moula: Specialises in lending to SMEs based on real-time business performance, including cash flow data.

- OnDeck: Provides unsecured loans to SMEs, focusing on companies with solid revenue but limited assets.

- Capify: A major player in revenue-based financing, Capify provides loans that are repaid as a percentage of future revenue, which is particularly attractive to retail and hospitality businesses.

Comparison with Traditional Banks

While the Big Four banks still dominate overall SME lending, their market share is shrinking in certain segments. Traditional banks continue to offer lower interest rates on secured loans (where businesses have substantial collateral). However, banks are often viewed as slower and more risk-averse, making them less appealing for SMEs that need quick decisions or face unconventional risks.

Additionally, banks tend to favor businesses with more predictable cash flows and strong asset bases, whereas non-bank lenders are more willing to work with businesses with fluctuating revenues or less tangible assets.

Impact of COVID-19

The COVID-19 pandemic accelerated the shift towards non-bank lending. Many SMEs, especially in industries like retail and hospitality, were unable to secure the funding they needed from banks due to uncertainty around future earnings. Non-bank lenders stepped in with revenue-based financing and flexible repayment schedules that helped businesses weather the storm.

According to AFR (Australian Financial Review), non-bank lenders saw a 35% increase in loan applications from SMEs during the pandemic, as businesses sought faster and more flexible financing solutions. This growth in demand helped solidify the role of non-banks in the Australian SME lending market.

Future Outlook for SME Lending

The trend of SMEs turning to non-bank lenders is expected to continue, particularly as businesses look for faster, more flexible funding solutions. However, regulatory changes could impact this growth. APRA and the Reserve Bank of Australia (RBA) are monitoring the rise of non-bank lending to ensure that it does not create systemic risks for the broader financial system.

One potential risk is the higher interest rates often charged by non-bank lenders. While businesses benefit from quicker access to capital, they also pay a premium for this flexibility, which can lead to financial strain if cash flow issues arise.

Conclusion

The past five years have seen non-bank lenders significantly increase their market share in the Australian SME lending space. Offering faster, more flexible loan products, non-banks have positioned themselves as key players, especially for businesses in need of quick funding or those unable to meet traditional bank requirements.

With SMEs accounting for nearly 98% of all businesses in Australia, the competition between banks and non-banks for their lending needs will continue to intensify. For SMEs, the rise of non-bank lenders provides more options and greater flexibility, helping them access the capital they need to grow and thrive in a competitive market.

This evolving landscape is worth watching closely, as regulatory changes and market dynamics will shape the future of SME lending in Australia.

What are the different types of loans available to SME’s?

Here are the most common loan types offered by non-bank lenders to SMEs in Australia and how they help businesses manage cash flow:

1. Unsecured Business Loans

These loans don’t require collateral, making them faster to access. They are ideal for SMEs needing quick cash for operational expenses, expansion, or marketing. However, they may come with higher interest rates due to the risk.

2. Invoice Financing

This allows businesses to borrow against outstanding invoices, giving immediate cash flow without waiting for customers to pay. It’s especially useful for managing day-to-day expenses or short-term liquidity gaps.

3. Equipment Finance

SMEs can finance the purchase of essential equipment (e.g., machinery or technology) without large upfront costs. This ensures businesses can maintain or grow operations without depleting cash reserves.

4. Line of Credit

This works like a credit card for businesses, offering a flexible cash source to draw upon when needed. It helps SMEs manage fluctuating cash flow by only paying interest on the amount drawn.

5. Revenue-Based Financing

Repayments are based on a percentage of future business revenue, making it flexible and beneficial for businesses with variable income (e.g., retail or hospitality). It aligns repayments with cash flow, reducing pressure during slower months.

6. Trade Finance

This loan type helps importers and exporters cover the upfront costs of buying goods from overseas suppliers, ensuring smooth operations and sufficient working capital throughout the trade cycle.

7. Merchant Cash Advances

This is a lump-sum payment based on future sales. Repayments are made as a percentage of daily credit card sales, making it ideal for retail or hospitality businesses with fluctuating sales patterns.

Each of these loans can be tailored to help SMEs manage their cash flow more effectively, ensuring they can maintain operations, invest in growth, and navigate financial challenges without relying solely on traditional bank loans.

Reach out to the team at Broker.com.au – Australia’s #1 business finance broker.