Business finance

Low Doc Car Loans

A low doc car loan is a type of vehicle finance product often used if you are self-employed, or own a small trade business, and are similar to secured car loans.

Loan size

$5K To $100K

loan term

2 to 8 years

Interest rate

5% to 10%

Approval speed

Medium

Low doc car loan

Key features of a low doc car loan

The main difference between low doc car loans and other car loans is the required supporting documentation used for approval and how you verify your income (which may include a signed income declaration, and extensive details on any open contracts or agreements which may affect your income).

Compare a loc doc car loan

Advantages and disadvantages

Low doc car loans are commonly used to finance a vehicle if you cannot provide the financial statements necessary for standard car finance.

Advantages

What are the advantages of a low doc car loan

- Finance a vehicle if you cannot provide necessary income details for standard car loans

- May only require a declaration of income

- Available for business-owners and self-employed contractors

Disadvantages

What are the disadvantages of a low doc car loan

- May have higher rates than standard car finance

- May include early repayment fees

- May need to self-assess your ability to meet repayments under your income declaration

Common uses and good to know

Everything else about a low doc car loan

Common uses

Low doc car loans are especially popular with Australian tradies, who have trouble providing traditional verification of income.

They are also commonly used by other self-employed individuals or owners of a small business, who do not qualify for other types of vehicle finance.

Good to know

As the assessment and approval process is slightly more complex with low doc car loans, it’s a good idea to prepare your documents before applying with a lender.

This includes standard documents such as identification, proof of address, and details about the vehicle you are buying. You may also need to prepare details about your business (if you are self-employed) and specifics around any contracts or working agreements you have which may affect your income.

Australian tradies looking to finance a vehicle primarily for business use may want to see if they qualify for a chattel mortgage instead of a low doc car loan.

Alternative Commercial Lending options

Other Business Finance Products

Secured Business Loan

A secured business loan is a loan made by a bank or finance company where the lender requires the borrower to pledge assets as collateral against the loan.

Business line of credit

A business line of credit is a very flexible form of lending where you have cash available to draw down on as and when you need it.

Trade finance

Trade finance is any form of finance that is issued to support international trade, including letters of credit, debtor finance, & export credit.

Unlocking Business Lending Opportunities in Australia: What 2025’s Shifts Mean for You

Australia’s business lending is shifting fast in 2025—learn what it means and why now’s the time to act.

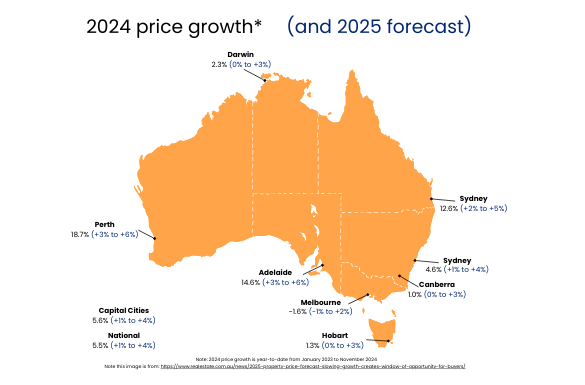

2025 Australia’s Property Market Outlook: Powerful Trends Shaping Your Next Smart Move

Australia’s property market is seeing rare buying opportunities as growth slows and supply stays tight. Act now with the right broker.

Low doc car loans FAQ

Frequently asked questions

Low doc car loans provide access to vehicle finance when the borrower is unable to provide sufficient documentation required for standard loan approval.

You will generally qualify for a low doc loan if you are unable to meet qualifying criteria for a standard car loan, and cannot provide proof of income and tax returns for the past two years.

To qualify, you may be asked to sign an income declaration, and prove your ability to meet repayments. You’ll still need to meet basic lender criteria, be an Australian citizen or permanent resident, and may be required to hold an ABN (Australian Business Number).

Traditional car loans usually require full documentation, while low doc car loans require less paperwork and are often faster to process. However, low doc car loans usually come with higher interest rates and fees to compensate for the increased risk taken by the lender. Traditional car loans are usually more suitable for borrowers with stable employment and a good credit record, while low doc car loans are more suitable for self-employed borrowers, small business owners, or those with a poor credit history. It is important to carefully consider the pros and cons of each option before making a decision.

Low Doc home loans are often perceived as higher risk by the lenders, because the income of the borrower cannot be substantiated by conventional means. As a result, a Low Doc loan would usually have a higher-than-average interest rate; plus more limitations in terms of the maximum Loan to Valuation Ratio (LVR), available loan features and package discounts.

The amount of documentation required for a low-doc car loan is, as the name suggests, minimal. You won’t need to provide as many pay slips and tax returns as standard personal loans. This means the process to apply is far simpler and less time consuming.

With a low doc car loan, you might face a higher interest rate and a smaller borrowing amount. Additionally, you may be required to provide a larger deposit or pay a higher fee if you have a limited credit history. It’s important to consider the limitations of a low doc car loan before applying and make sure it’s the right fit for your financial situation. As always, it’s recommendable to compare loan options and seek professional advice to find the best choice for you.